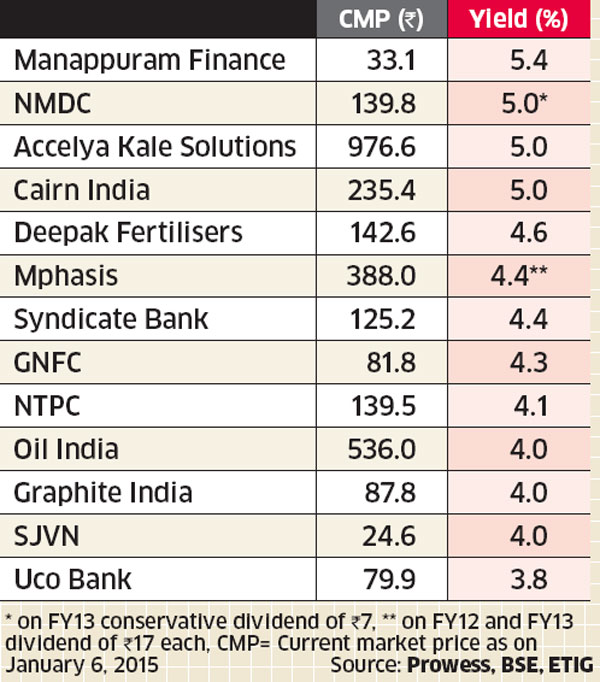

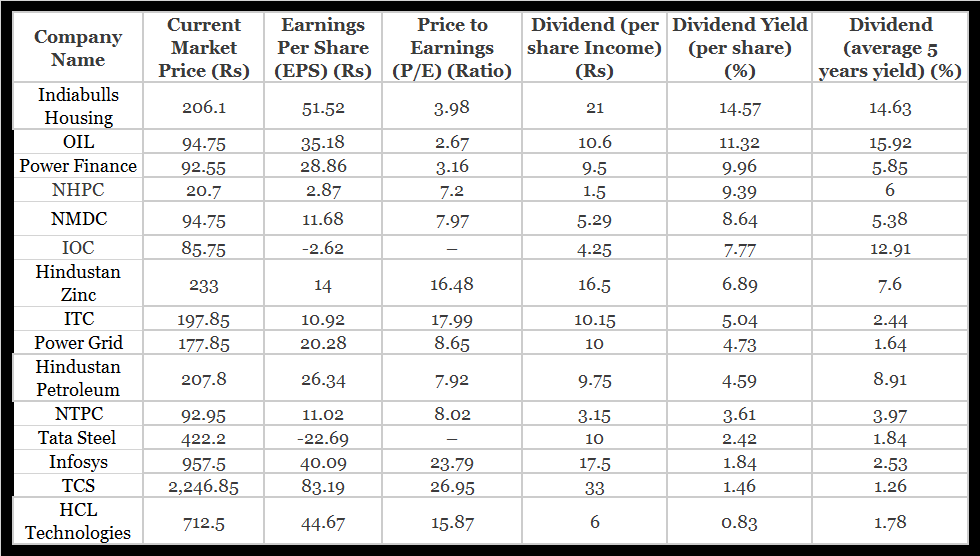

Leggett Platt designs and manufactures a wide range of products and components that are common to. By yield the best dividend stocks as of March 31 are listed below.

/dotdash_Final_Forward_Dividend_Yield_2020-01-167ed1a41c1c48599fa394f4f4faf342.jpg) Forward Dividend Yield Definition

Forward Dividend Yield Definition

The annual dividend payout of 252 a share offers investors a well above-average 77 yield.

Annual dividend stocks. You might be initially thrilled with your impressive 10 annual dividend yield 3 dividend divided by 30 stock price. The beverage giant has been a fantastic dividend stock for generations and has increased its dividend for 59 consecutive years. Subscribe to Sure Dividend.

Expenses can also be lower with dividend stocks as ETFs and index funds charge an annual fee called an expense ratio to investors. Investors nearing retirement are attracted to high dividend stocks because of the generous passive income they can provide. If youre interested in buying stocks with increasing dividends that are poised for long-term growth youll love this list of the 50 highest dividend paying stocks with strong fundamentals.

Ample cash on hand. High quality dividend paying stocks provide both dividend income and the potential for stock price growth. To compile the list Goldman Sachs identified stocks from the Russell 1000 index that met a number of requirements.

At least average performance since the market peak. They realize a total return of 025share. Bonus sambutan untuk pemula.

It operates through the following. Check out the list below and sort by company yield or dividend. However expected annual FFO-per-share growth of 69 plus the 52 dividend yield lead to expected total annual returns of 131 per year over the next five years.

Well also cover the key metrics to consider before buying in more detail below. A minimum annualized dividend yield of 3. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

Ranked 3 in Top Dividend Stocks. However not all high yield dividend stocks are safe. Which Are The Best Dividend Stocks.

Ad Buat prediksi dan lihat hasilnya dalam 1 menit. Pengaturan trading yang fleksibel. While sugary soft drinks may indeed be in the early.

Is a holding company which engages in the operation of quick service restaurants. Ad Buat prediksi dan lihat hasilnya dalam 1 menit. Why the highest dividend paying stocks.

Buying Dividend Stocks Dividend stocks have remained one of the most reliable ways to collect steady income from the stock market. MPLX Enterprise and Williams are at the top. Learn more about dividend ETFs The Dividend.

They collect the dividend of 050 on the payment date. Restaurant Brands International Inc. But all of these Dependable Dividend Stocks are rock-solid when it comes to preserving capital and making regular dividend payments.

Bonus sambutan untuk pemula. The highest paying dividend stocks can offer a yield greater than 4 a year and some high dividend paying stocks even yield more than 10 a year. This is enough to temp even many income-starved investors.

853 rows In both cases an investor that owned 100 shares of stock would receive a. They lost 025 on the stock but gained 050 on the dividend distribution. Buy the stock prior to the ex-dividend date for 100.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. Lets say you buy a 30-a-share stock that pays 3 a year in dividends. Pengaturan trading yang fleksibel.

Sell it on the ex-dividend date for 9975. An SP credit rating of at least BBB.