At least 65 years of age and your gross income is 14050 or more. Lets take a look at how Social Security works and what you need to.

Howstuffworks How Social Security Works

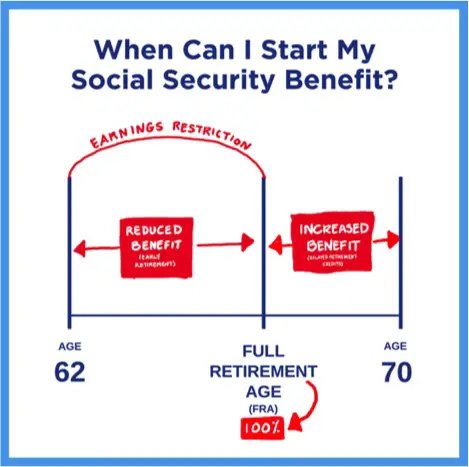

If you claim at 62 youll get roughly 75 of what you would have received had you waited several years for what the government calls your full retirement age when you get 100 of what youre eligible for.

What age do you get social security. The simplest way to get an SSN and Social Security card for your child is to apply for it immediately after they are born. You can start collecting Social Security benefits any time between ages 62 and 70. If this is the only income you receive then your gross income equals zero and you dont have to file a federal income tax return.

If you will reach full retirement age in 2021 the limit on your earnings for the months before full retirement age is 50520. The benefit of signing up for Social Security at 62 is that you get your money as soon as youre eligible and youre not taking on the financial risk of dying at a relatively young age. Full retirement age is currently 66 and 2 months and is gradually increasing to 67 for people born in 1960 or after.

Start Social Security Payments at Age 70 The maximum Social Security benefit changes based on the age you start your benefit. Your Social Security retirement age and the amount you receive varies depending on several factors. You can start receiving your Social Security retirement benefits as early as age 62 and as late as age 70.

The earlier you claim the lower your monthly benefit will be. For example the earliest age you can collect your Social Security retirement benefits is 62 but there is an exception for widows and widowers who can begin benefits as early as 60. You can request an SSN while filling out the information for their birth certificate.

70 is the best age for claiming Social Security benefits. You are entitled to full benefits when you reach normal retirement age or full retirement age according to the Social Security Administration. Once you reach your full retirement age or FRA you can claim 100 percent of the benefit calculated from your lifetime earnings.

Starting with the month you reach full retirement age you can get your benefits with no limit on your earnings. En español You receive the highest benefit payable on your own record if you start collecting Social Security at age 70. And this makes sense.

There is no minimum age for a child to get a Social Security card. By now you may have heard. Use our Retirement Age Calculator to.

Workers who are eligible for Social Security can start payments at age 62 regardless of their full retirement age. Regardless of your full Social Security retirement age which ranges from 65 to 67 you can collect retirement benefits as early as age 62 as long as youve paid into the program for at least 40. However if you live on Social Security benefits alone you dont include this in gross income.

You can claim Social Security as early as 62 and as late as 70. About 29 of men and 33 of women filed for Social Security benefits at that age in 2017 according to the Social Security Administration. However the benefit reduction for early claiming is bigger for those who have.

/tsa-security-officer-career-profile-974523-Final-4a25d752cd9a4d1b905b31d2c33a116b.png)

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)