It is advisable to get a competent financial planner that will help you manage your individual stocks. Losses on taxable accounts can be deducted and as traditional IRA balances go down it means fewer income-taxable dollars in the portfolio.

Roth Iras How To Optimize Yours For 2021

Roth Iras How To Optimize Yours For 2021

Thats because in general an IRA allows investments in all kinds of financial vehicles.

Roth ira individual stocks. You invest in a Roth with after-tax dollars that can then grow and compound free of tax. Actually the allocation breakdown is only four areashigh-yield stocks high-yield corporate bonds preferred stocks and REITs. Why stocks in a Roth IRA are smart The key attribute of a Roth IRA is that any gains on the assets within the account are tax free even when you withdraw them in retirement.

Investors should investigate stocks or stock funds and make sure these investments are prudent and. Roth IRA vs Regular IRA The Roth IRA is a special type of IRA but a lot of the same rules apply so we can general your question to not be Roth specific. A Roth individual retirement account or IRA is one of the best places to save for retirement you put money in after paying income taxes on it but then your account grows entirely tax-free.

But withdrawals from your Roth IRA. For the most part picking stocks for a Roth IRA is the same as picking stocks for any account. Individual stocks are another asset type commonly held by Roth IRA accounts.

The short answer is still technically yes. A Roth IRA Is A Great Place To Hold Equities Whether Individual Stocks Or Equity Mutual Funds I believe that a Roth IRA is a great place to hold equities whether individual stocks or equity mutual funds. The individual issues allow for some outperformance if high-quality companies are purchased and outperform over the next five years.

Like any other retirement account a Roth IRA has flexible limits on what you can hold as investment assets within your Roth IRA including stocks bonds ETFs bank accounts CDs mutual funds mixed asset funds and cash alternatives. Roth IRAs For Beginner Investors. Depending on your retirement plans you can have all of the Roth IRA investments listed above.

6 Of course the. Unlike the traditional IRA or 401 k the Roth IRA is funded with post-tax income. One of the beauties of the Roth Guay says is that you can withdraw any money youve put into the IRA at any time without taxes or penalties.

In fact Roth IRA investors are more exposed to equities than their traditional IRA counterparts. The advantage of holding them within a Roth IRA is that there will not be any taxes related to the assumed appreciation of the positions. While youre looking to open a Roth IRA account with a reputable company with full advertiser disclosure like Charles Schwab it is essential to know that there are special rules when trading stocks using your Roth IRA.

The mutual funds and ETFs provide additional diversification and safety. As a result your money then grows 100 tax-free. And after your account has been open at least five.

The recommendation then to hold high-return stocks in a Roth IRAor in any type of IRAflies directly in the face of classic asset location best practices. Roth IRAs are one of the best tax advantages plans for investing for retirement. By working with a diversified investment broker youll be able to choose from individual stocks bonds options.

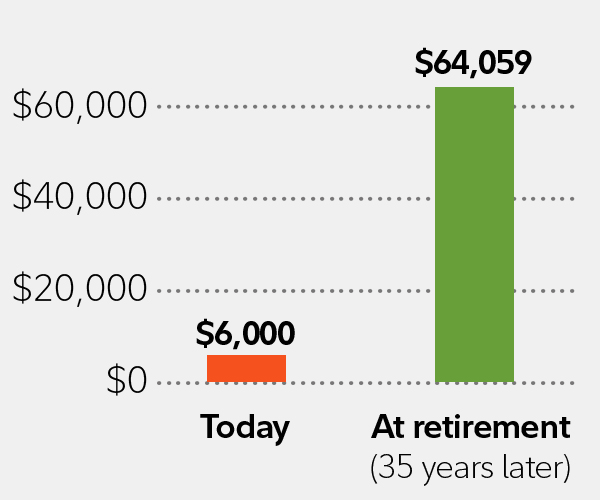

Roth IRA Investment Options and Restrictions. Withdrawals will also be tax-free once you reach the age of 59 ½ and youve held the Roth for. Those who maximize their Roth IRA contributions at an early age potentially have the opportunity to become a tax-free millionaire by the time they reach retirement age.

Find out the best brokerage to open a Roth IRA today. Note that for the preceding calculations weve assumed that the IRA is a Traditional IRA not a Roth. Can I buy stocks with my IRA.