The Dow Jones Industrial Average is a widely watched stock market index composed of 30 large publicly owned US. Today the average yield of the 10 highest-yielding Dow Jones Industrial Averages stocks is 388.

39 rows Maximum Value.

Dow jones dividend yield. For investors looking for high-yielding dividend stocks to buy the highest dividend payers in the Dow Jones Industrial Average DJIA is a common starting point. DOWs most recent quarterly dividend payment was made to shareholders of record on Friday March 12. Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks.

Average Dividend Yield of Non-Zero Dividend Yields. Average Dividend Yield of. Below is a list of the 10 highest yielding Dow stocks.

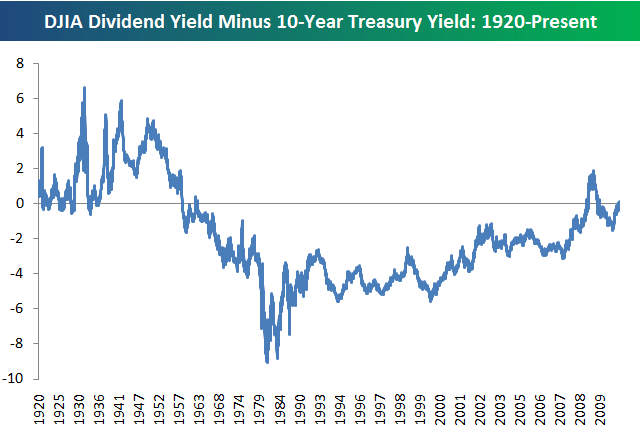

The current TTM dividend payout for Dow Jones Industrial Average INDU as of December 06 2018 is 61724. The current TTM dividend payout for SPDR Dow Jones Industrial Average ETF DIA as of April 19 2021 is 570. After the huge gains seen in the Dow Jones since August 1982 five years 250 advance it was time for a bear market ending with a Dow Jones dividend yield at or above 6.

The Dow Jones Industrial Average DJIA yield is the aggregate dividend yield on the 30 stocks that make up the Dow Jones Industrial Average DJIA. 39 rows Dow Jones Industrial Average Dividend Yields. All Dow Jones Industrial Average Stocks.

Minimum Value of Non-Zero Dividend Yields. Historical dividend payout and yield for Dow Jones Industrial Average INDU since 1971. Diamonds Trust is a unit investment trust.

SP Dow Jones Indices Reports 23 Billion Decrease in US. It is the second-oldest US. The current dividend yield for Dow Jones Industrial Average as of December 06 2018 is 183.

Annual payout 4 year average yield yield chart and 10 year yield history. Getting close to the dividend aristocrats status. Also the average number of consecutive years of dividend increase is high with almost 22 years.

The average dividend yield for the Dow-30 is 262 which is already a good rate. The dividend yield measures the ratio of dividends paid share price. The Dow Jones Industrial Average is made up of 30 of the most established and mature US.

Standard Deviation of of All Dow Jones Industrial Average Stocks. Average Dividend Yield of All Dow Jones Industrial Average Stocks. Companies that pay dividends tend to have consistent positive net income.

But that didnt happen. Here are the 10 highest. The current dividend yield for SPDR Dow Jones Industrial Average ETF as of April 19 2021 is 167.

Companies so it shouldnt come as a surprise that many of the index components pay strong dividends. The Fund tracks the Dow Jones Industrial Average Yield Weighted Index which holds. Invesco Dow Jones Industrials Average Dividend ETF is an exchange-traded fund incorporated in the USA.

Market index after the Dow Jones Transportation Average it was first used on May 26 1896. DOW NYSEDOW Dividend Information DOW pays an annual dividend of 280 per share with a dividend yield of 434. Also the average number of consecutive years of dividend increase is high with almost 22 years.

The Dow Jones Industrial Average is a stock market index that indicates the value of 30 large publicly owned companies based in the United States. Indicated Dividend Payments for Q3 2020 Up from Q2s 425 Billion Decline Index News. Instead Greenspan inflated a historic bubble in the stock market where in January 2000 the Dow Jones yielded an incredible 130 see chart above.

The average dividend yield for the Dow-30 is 262 which is already a good rate. Getting close to the dividend aristocrats status. SPDR Dow Jones Industrial Average ETF DIA dividend yield.

Standard Deviation of Non. The price-weighted average is considered a proxy for general market conditions in the United States. It is not longer representing heavy industries but rather important companies compiled to gauge the performance of the.

.1559047328632.png)