Erie County does not assume any liability associated with the use or misuse of this data. Erie PA July 29 2020 City Treasurer Casimir J.

Erie County Property Assessment Tips For Understanding Recent Changes

Erie County Property Assessment Tips For Understanding Recent Changes

Town of Cheekowaga Senior Center 3349 Broadway.

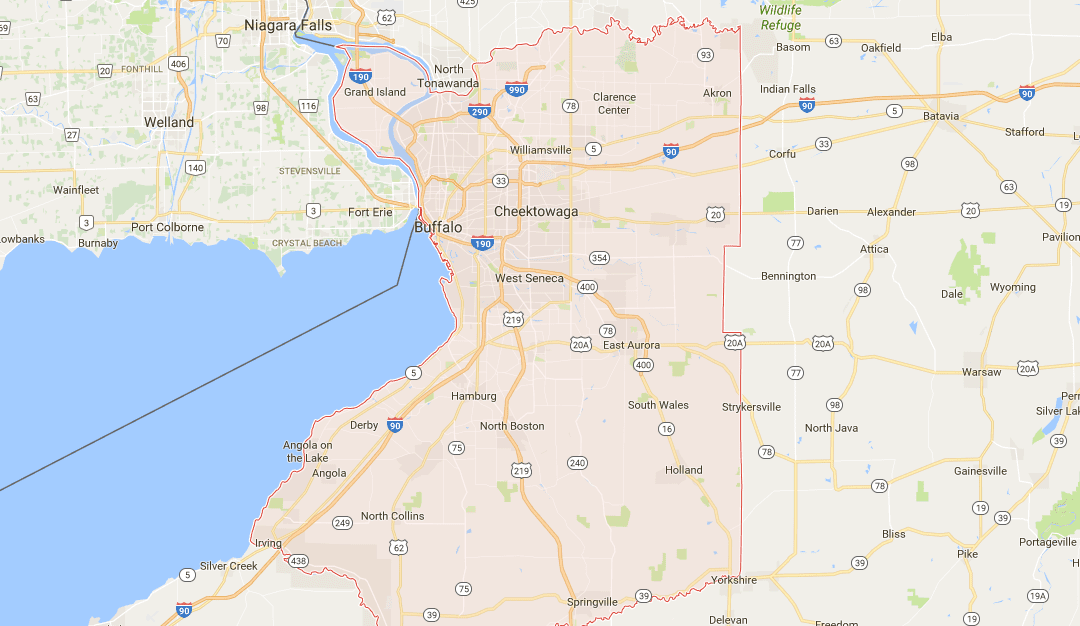

Erie county property tax. All fields are not required. Erie County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Erie County Ohio. O Microsoft Internet Explorer or Microsoft Edge Chrome Firefox and Safari are not supported Enter ONE of the fields below to begin your search.

Search Erie County property and tax records. How to Purchase Tax Foreclosed Property. The median property tax in Erie County New York is 3120 per year for a home worth the median value of 117700.

When entering Street Name enter name only - do not enter Street St Road Rd etc. If the taxes. In-depth Erie County NY Property Tax Information.

Please click here to see the Erie County website for further information. Paying Delinquent Property Taxes. Erie County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Erie County Pennsylvania.

The Erie County Courthouse is located at 140 West 6th Street room 110 and is open Monday -. Erie City Real Estate Taxes are based on a calendar year from January 1 thru December 31 of the current year. Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100.

If you pay after May 31 a 10 penalty is added to your taxes until the end of the year. The Tax Sale is now scheduled to be held at the Bayfront Convention Center 1 Sassafras Pier Erie PA beginning at 10 am with bidder registration beginning at 9 am. Erie County has one of the highest median property taxes in the United States and is ranked 145th of the 3143 counties in order of median property taxes.

These records can include Erie County property tax assessments and assessment challenges appraisals and income taxes. Erie County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100.

Property. ERIE COUNTY PENNSYLVANIA Erie County government is committed to serving our citizens building stronger communities and enriching the quality of the life. If anyone does not receive their tax bills by the end of August please call our office at 870 1210.

These records can include Erie County property tax assessments and assessment challenges appraisals and income taxes. Erie County collects on average 265 of a propertys assessed fair market value as property tax. Parcel numbers contain 14 numeric characters without spaces.

These records can include Erie County property tax assessments and assessment challenges appraisals and income taxes. City tax payments are due and payable on May 31. There are three major roles involved in administering property taxes - Tax Assessor Property Appraiser and Tax CollectorNote that in some counties one or more of these roles may be held by the same individual or office.

Attendance to the auction may need to be restricted to active bidders depending on the. Taxpayers who own property within the City of Buffalo can pay their current Erie County Property Taxes on-line. Notice is hereby given by the Erie County Tax Claim Bureau that the location of the September 28 2020 Upset Tax Sale has changed.

Delinquent property taxes are handled through the Erie County Courthouse. Payment can be made with a Credit or Debit card VISA MASTERCARD DISCOVER AMERICAN EXPRESS or an Electronic Check. Erie County Real Property Tax Services.

Kwitowski would like to notify City of Erie Taxpayers that the 2020 SCHOOL Property Taxes are in the mail. City of Erie 2020 School Property Taxes. The median property tax also known as real estate tax in Erie County is 312000 per year based on a median home value of 11770000 and a median effective property tax rate of 265 of property value.

Erie County Assessors Office Services. WELCOME TO THE ERIE COUNTY REAL PROPERTY TAX ONLINE PAYMENT SITE. July 26 2019 Tomorrow morning.

If you pay your bill on or before the last day of March you receive a 2 discount. Networking 595 people. To pay current Erie County Property Taxes.

Erie County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Erie County New York. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. SAT JUL 27 2019.