The higher it is the more expensive itll be for you to borrow. APR stands for Annual Percentage Rate and is the cost of borrowing money over a year on a credit card or loan.

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

APR gives you an estimate of how much your credit card borrowing will cost over a year as a percentage of the money borrowed.

Standard credit card apr. According to the Federal Reserves data for the third quarter of 2020 the average APR across all credit card accounts was 1458. Ad Minimize your risk and protect your ecommerce store from fraud. So anything lower would be considered a good APR for a credit card.

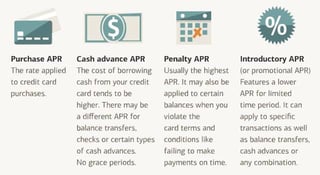

For example rewards credit cards can generally have higher average APRs to make up for additional benefits. Many credit cards also have higher APRs that apply to cash advances or a penalty APR thats imposed when the account holder misses payments. The average credit card APR isnt necessarily reflective of the APR youll receive on a credit card youre approved for though.

When deciding between credit cards APR can help you compare how expensive a transaction will be on each one. When youre looking at potential credit cards or loans you may see representative APR advertised. The best fraud prevention strategies for E-commerce.

Given that lenders offer different. It takes into account interest as well as other charges you may have to pay such as an annual fee. Some credit cards offer an introductory APR which is typically 0 and can apply to purchases balance transfers or both.

Ad Find 5 Best Credit Cards and Related Articles. The best fraud prevention strategies for E-commerce. A single credit card may have several APRs each applying to a different type of transaction such as purchase cash advance or balance transfer.

Watch our video for more information. APR stands for Annual Percentage Rate. The standard APR annual percentage rate comes into effect after the introductory period expires.

Our Experts Found the Best Credit Card Offers for You. If you know how to navigate an introductory purchase APR offer on a credit card you can save money on interest and get extra time to pay off expensive charges during the 0 intro APR period. Its helpful to consider two main things about how APR works.

The average credit card APR varies significantly depending on the type of card. The average credit card cash advance APR is 2032. How its applied and how its calculated.

Also known as the go-to rate. The average credit card with a 0 introductory APR on purchases gives you almost 11 months without interest. Ad Get a Card with 0 APR Until 2022.

Most credit cards have an APR range that will depend on your creditworthiness so we also focused on low and high figures. Withdrawing money from an ATM or bank branch using your credit card triggers this rate. A cards purchase APR is the rate of interest the credit card company charges on purchases if you carry a balance on the card.

Our Experts Found the Best Credit Card Offers for You. APR is an annualized representation of your interest rate. Ad Minimize your risk and protect your ecommerce store from fraud.

Ad Get a Card with 0 APR Until 2022. According to the Federal Reserve the average rate for credit card accounts that assessed interest was 1661 at the end of the first quarter of 2020. For example many credit cards have a 0 introductory APR or another lower-than-standard rate that applies for a limited time after the account is opened.

The lower it is the cheaper itll be for you to borrow. Balance transfer intro APRs last more than 12 months on average. Ad Find 5 Best Credit Cards and Related Articles.

Your purchase APR is the standard APR that applies when you make purchases.