If you fail to pay your credit card bill before that then you need to be paying extra interest for the outstanding amount. When Is the Best Time to Pay My Credit Card Bill.

How Paying A Credit Card Statements Work Credit Card Insider

How Paying A Credit Card Statements Work Credit Card Insider

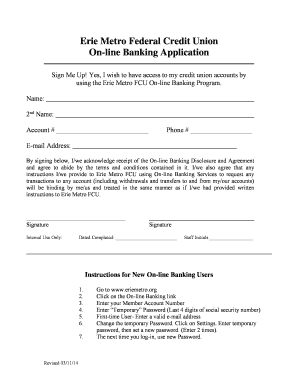

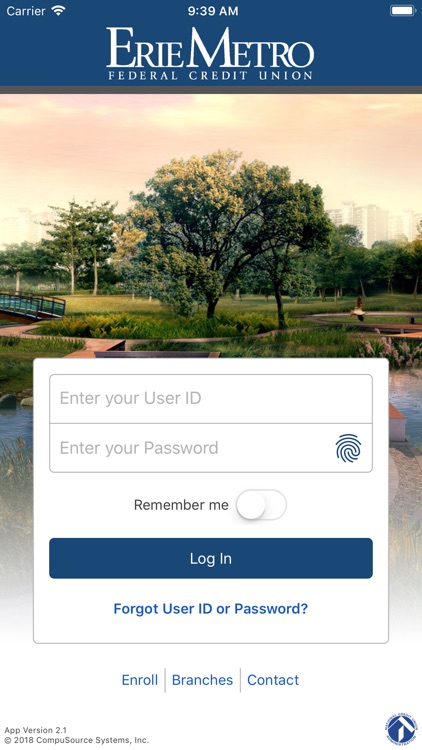

You can often do this automatically when you make your first purchase by entering a username and password.

When to pay credit card. Aim to pay your credit card bill in full by your statement due date. When should you pay off your credit card balance. Transfer the balance s from the high-interest rate cards to the new card.

Ideally you should always pay your credit card bills before or till the due date. Your credit card issuer will specify the minimum payment you need to make each month as well as a due date for your payment. If you do this and your card has a grace period you wont pay interest on your new credit card purchases.

Please allow at least 1 working day to process. How much should I pay on my credit card to avoid interest. This may be a good option for you if the reason youre having trouble paying credit card debt is due to illness job loss natural disaster or another temporary hardshipYou may be able to arrange for lower minimum payments interest rates and fees and you may be able to suspend payments without penalty for a limited period of time.

The only bad time to pay your credit card bill is after your payment is duea mistake that can have significant negative repercussions for your credit score. When should I pay my credit card bill. Months Until Pay Off How long it will take you to pay off a credit card.

When Should You Pay Off Your Credit Card Balance. Pay off your balance on the new card before the 0 APR period ends usually 6 to 18 months Using the same Card C from above you could transfer 9000 of credit card debt at an 18 APR to. Some businesses ask you to create an account when you complete a purchase.

Credit cards cant be used to directly pay off another credit card. For instance if you make a large purchase or find yourself carrying a. By paying at least the.

Ideally you would pay your full statement balance before the payment due date each month. You should always pay your credit card bill by the due date but there are some situations where its better to pay sooner. You will be prompted to choose how you want to pay.

Paying the full statement balance each month has a positive impact on your credit and shows lenders that youre able to responsibly borrow money. Hardship Payment Agreement. When you pay off your card completely with each billing cycle you never get charged.

With a personal loan you can pay off your credit card debt right away and set up a payment plan to repay your one personal loan. But if you cant pay your statement balance in full dont worryjust try to make the minimum payment by the due date. Principal Paid The amount of your payments that paid principal.

Choose credit card as your payment method. Making multiple payments to credit card accounts is a time-honored approach to keeping a lid on your debts and promoting good credit scores. To ensure the success of the payment it is important that you have adequate fund in your currentsaving account during the time of your Citi Credit Cards amount due.

Balance Owed The total outstanding balance you. However balance transfers and cash advances can be used to pay card balances. Total Interest Paid The amount of interest you will pay over the course of your debt payoff plan.

Your Citi Credit Cards payment will automatically be deducted from your Citibanks currentsaving account on the due date. Paying early also cuts interest In general we recommend paying your credit card balance in full every month.

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg)

/GettyImages-1041512942-69d44b3432c342469fb14e34e370f6bc.jpg)