No matter what youre buying you can take some extra time to pay by using a credit card with a 0 APR period. The right 0 credit card could help you avoid interest entirely on big-ticket purchases or reduce the cost of existing debt.

How Do 0 Apr Credit Cards Work Everything You Should Know Valuepenguin

If you know how to navigate an introductory purchase APR offer on a credit card you can save money on interest and get extra time to pay off expensive charges during the 0 intro APR period.

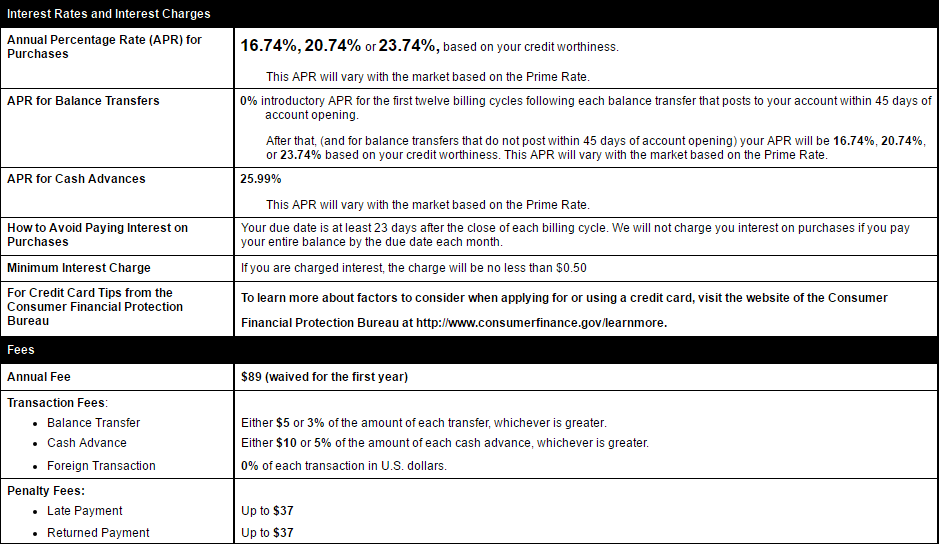

Credit card purchase apr. Credit cards may offer a 0 intro APR on purchases a 0 intro APR on balance transfers or a 0 intro APR on both types of transactions. A good APR for a credit card is anything lower than the average credit card APR which is 1452. Our Selection Criteria Is a 0 APR Card Right for You.

Intro Balance Transfer APR is 0 for 14 months from date of first transfer for transfers under this offer that post to your account by July 10 2021 then the standard purchase APR applies. The three main types of APR are fixed rate variable rate and promotional rate. Intro purchase APR is 0 for 14 months from date of account opening then the standard purchase APR applies.

After that the issuer must send you a 45-day advance notice that warns you of an upcoming. Make the purchase s and youll pay no interest charges on the balance for the entire length of the 0 period. Given that lenders offer different.

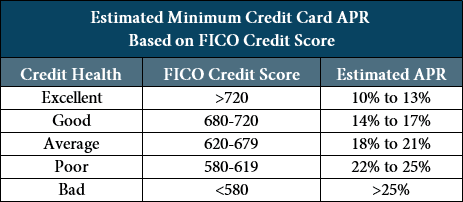

If you only make purchases and pay off your ending balance each month by the due date you pay just the amount you owe with no interest. When youre looking at potential credit cards or loans you may see representative APR advertised. A good APR for a credit card is 14 and below.

A credit cards APR is an annualized percentage rate that is applied monthlythat is the monthly amount charged that appears on the bill is one-twelfth of the annual APR. However if you opt to carry a balance on your card you pay the agreed-upon interest on your outstanding balance. Its the interest rate you pay for the things you buy using your credit card.

Find a low interest card at a rate lower than 1452 and youre doing good. Variable APRs are far more common. Ad Get a Card with 0 APR Until 2022.

With fixed rates your APR is likely to stay the same throughout the time you carry your card unless otherwise stated. Our Experts Found the Best Credit Card Offers for You. It takes into account interest as well as other charges you may have to pay such as an annual fee.

As of November 2020 the average APR charged for credit card accounts that incurred interest was 1628 according to the Federal Reserve. Consequently for credit cards the APR and the interest is the same. How to calculate APR.

A cards purchase APR is the rate of interest the credit card company charges on purchases if you carry a balance on the card. If you are carrying a credit card balance you will be charged APR interest at a rate that is calculated and determined by your credit card issuer. In other words its the rate at which a balance from purchases will accrue interest on an annualized basis if you dont pay your bill in full by the due date.

Fixed If your credit card has a fixed APR typically issued by credit unions the issuer cant increase the rate in the first year after you open the account. Thats roughly the average APR among credit card offers for people with excellent credit. Purchase APR Annual Percentage Rate refers to the amount of interest youll pay on something you bought with your credit card if you carry a balance from month to month.

Your credit cards regular purchase APR may be a fixed or variable rate. The APR you pay your credit card issuer for carrying a balance on your card is usually expressed as an annual rate. APR stands for Annual Percentage Rate and is the cost of borrowing money over a year on a credit card or loan.

And a great APR for a credit card is 0. This is also referred to as the purchase APR. Ad Get a Card with 0 APR Until 2022.

Here are the differences between the two. Most credit cards have. Our Experts Found the Best Credit Card Offers for You.

What is a Good APR for a Credit Card. The purchase APR on a credit card tells you how much more expensive the items that you charge to your card will become over the course of a year if you carry a balance from month to month. Generally credit card companies offer a grace period for new purchases.

What Is A Good Apr For A Credit Card Experian

What Is A Good Apr For A Credit Card Experian

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Apr Vs Interest Rate Surprising Differences Between The Two Numbers

Learn Just How To Purchase Apr Credit Rating Cards Josuekeoz982 Over Blog Com

Learn Just How To Purchase Apr Credit Rating Cards Josuekeoz982 Over Blog Com

What Is Credit Card Apr Why Is It Relevant Banking24seven

What Is Credit Card Apr Why Is It Relevant Banking24seven

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Apr Understanding How Apr Is Calculated Apr Types

What Is A Regular Purchase Apr 2021

What Is A Regular Purchase Apr 2021

What Is A Good Apr For A Credit Card Rates By Score

What Is A Good Apr For A Credit Card Rates By Score

Should I Take Advantage Of A Credit Card Reduced Apr Offer

Best 0 Apr And Low Interest Credit Cards Of April 2021 Nerdwallet

Best 0 Apr And Low Interest Credit Cards Of April 2021 Nerdwallet

What Is Credit Card Apr How Yours Affects You Mintlife Blog

What Is Credit Card Apr How Yours Affects You Mintlife Blog

8 Common Credit Card Fees Explained How To Avoid Them

8 Common Credit Card Fees Explained How To Avoid Them

Understanding Credit Card Aprs Interest Rates Valuepenguin

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.