Impact your credit score. Travel Rewards Credit Cards.

:max_bytes(150000):strip_icc()/credit-card--concept-credit-card-payment-1156857742-c265746dcaea46e6bcc5f0bcda1ed871.jpg) How To Qualify For A Credit Card

How To Qualify For A Credit Card

Low Interest Credit Cards.

What credit cards do i qualify for. This includes the Chase Sapphire Reserve and the Chase Sapphire Preferred Card. Show you credit cards that you may be approved for. If you receive a preapproval offer you can apply for the card with a higher level of confidence that youll be approved.

For the best chance of being approved for a credit card you want this number as low as possible. Credit card companies usually dont specify a minimum credit score thats needed to qualify but they may indicate which cards are designed for fair credit good credit or excellent credit. Compare business credit card offers to find the best one for you.

You can put your annual earnings from your part-time campus job on your credit card. You can qualify for other credit cards even if your credit is bad including the Indigo Platinum Mastercard or the Secured Mastercard from Capital One. If youve checked your credit score you can use that as a guide for choosing a card.

Plus if you actually have a good credit score in the high 600s or low 700s range you might qualify for credit cards with better rewards systems. Preapproval means the card issuer is fairly confident you can be approved for a credit card. Know your credit score so you know which cards you qualify for.

Julie Marie McDonough author of How to Make Your Credit Score Soar describes retail cards as the training wheels of credit cards. Ad Get a Card with 0 APR Until 2022. The general Chase credit card prequalify process includes all Chase cards.

0 Intro APR Credit Card Offers. Hotel Rewards Credit Cards. Owning a credit card can help you in a variety of other ways too.

Our Experts Found the Best Credit Card Offers for You. Our Experts Found the Best Credit Card Offers for You. Its important to qualify for a credit card for many reasons.

The income requirements dont require you to work full-time to get a credit card. Unlike debit and prepaid cards credit cards can help you achieve a credit score that will qualify you for the best interest rates on mortgages and loans. However youll need to have a regular source of income before you can be approved for a credit card.

Otherwise its likely youll have to have someone apply for a joint credit card with you. When you divide your monthly debt 1250 by your monthly income 3000 you get a DTI of about 42. The best credit cards for bad credit with no deposit and instant approval are the Credit One Bank Visa Credit Card and the Official NASCAR Credit Card from Credit One Bank.

You can earn 2 cash. If your credit score is below that but above 580 which is considered fair credit you may still qualify for decent cards like the Capital One Spark Classic for Business. Help you find the right credit card and may unlock elevated bonus offers if you qualify.

Pre-Qualified Credit Card Offers. In fact you can qualify for a small business credit card without incorporating your company in any way. For example you can receive a small business credit card even if youre just doing business as DBA which is operating under an unincorporated name.

You have monthly payments on your auto loan 200 student loan 250 and mortgage 800 for a total of 1250. You cannot fill out a Chase. Here are 5 steps to qualify for a business credit card.

Few secured credit cards offer rewards with the Discover It Secured Credit Card being an exception. If you have no credit history at all or youve had trouble getting approved for an unsecured credit card in the past you might still qualify for a secured credit card which requires a security deposit and is commonly used to build credit. The quartet of Chase prequalify and preapproval credit cards require you to have good or excellent credit to get one.

Have a small business with an intent to make a profit. The legal age to qualify for a credit card on your own is 18. In fact JPMorgan Chase is known for its rigorous approval standards so any opportunity you can take to check your winning odds is valuable.

Search through dozens of credit cards to find your ideal matches. Most of the best business credit cards on the market require that you have good or excellent credit. Ad Get a Card with 0 APR Until 2022.

Cash Back Credit Cards. No Annual Fee Credit Cards. According to FICO that means having a credit score of at least 670.

The Credit One Bank Visa Credit Card offers a credit line of at least 300 and charges 0 - 99 in fees per year. Rewards Points Credit Cards. Explore what it means to qualify for a credit card.

Just be aware that such cards usually come with annual fees. Applying for a credit card can be a key step in achieving your financial goals. Apply for a retail credit card.

No Foreign Transaction Fee Credit Cards.

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

What Credit Cards Do The Rich Have Quora

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

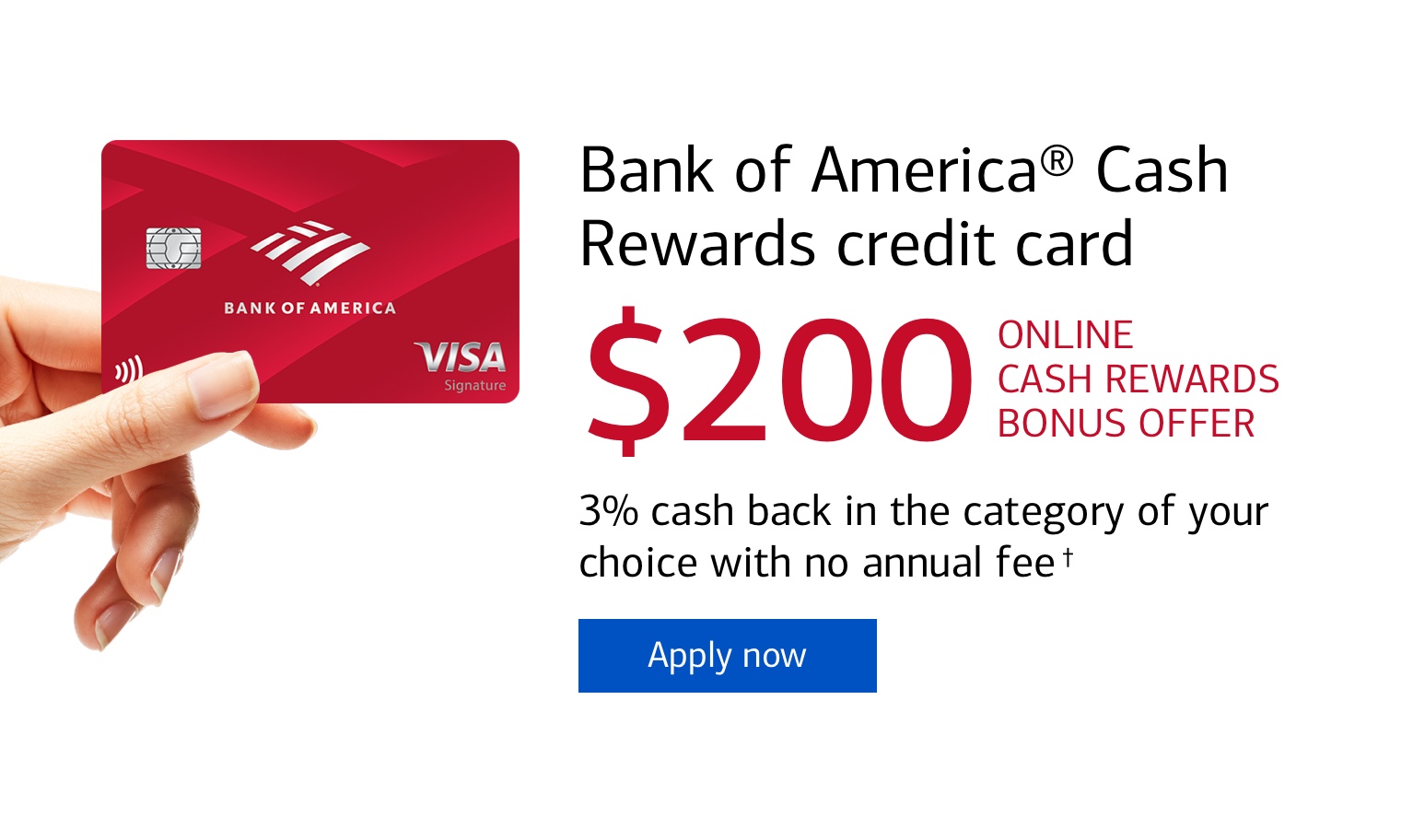

Credit Cards Find Apply For A Credit Card Online At Bank Of America

Credit Cards Find Apply For A Credit Card Online At Bank Of America

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

The Basics Of Credit Cards An Easy Guide To How Credit Cards Work

The Basics Of Credit Cards An Easy Guide To How Credit Cards Work

See If You Re Pre Qualified For A Credit Card Credit One Bank

See If You Re Pre Qualified For A Credit Card Credit One Bank

How Often Should You Apply For A New Credit Card Youtube

How Often Should You Apply For A New Credit Card Youtube

2021 S Best Credit Cards For People With No Credit

2021 S Best Credit Cards For People With No Credit

2021 S Best Unsecured Credit Cards For Bad Credit

2021 S Best Unsecured Credit Cards For Bad Credit

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

What Credit Card Do I Qualify For Discover

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.