Figuring out how much you can expect every month when you retire depends on a few criteria. In 2017 retirees get 90 percent of the first 885 of the AIME plus 32 percent of any AIME dollars between 885 and 5336 plus 15 percent of AIME amounts above 5336.

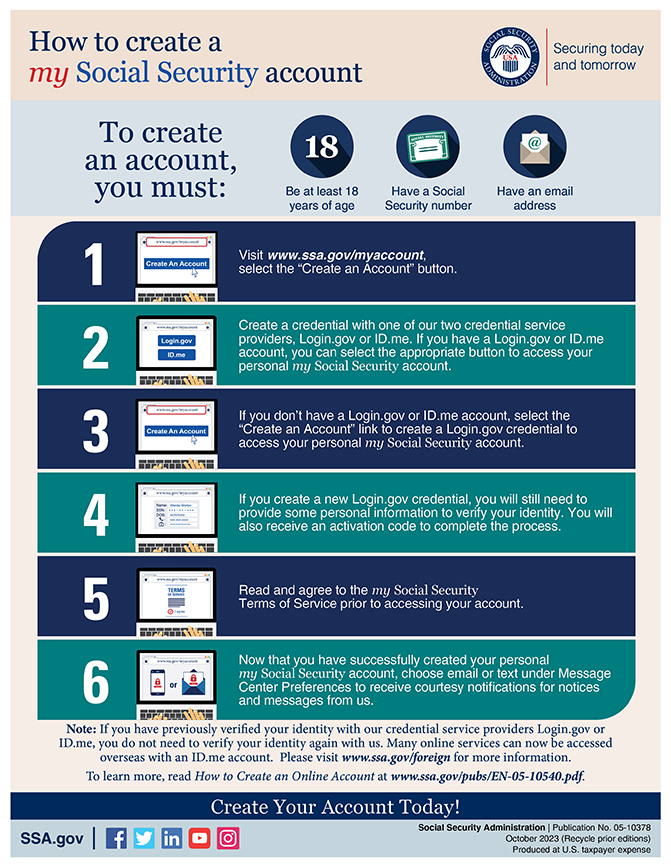

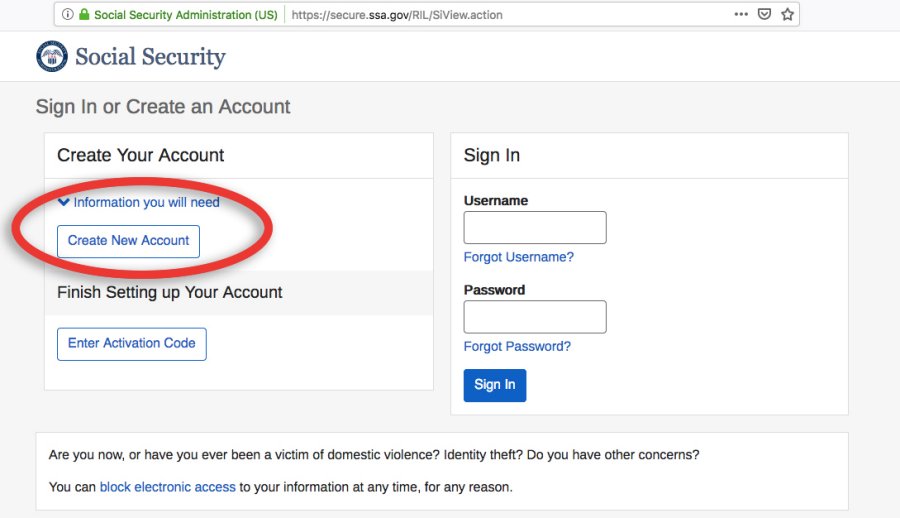

How To Create A My Social Security Account Social Security Matterssocial Security Matters

How To Create A My Social Security Account Social Security Matterssocial Security Matters

Next the SSA calculates 50 of your spouses PIA.

How much is my social security. Currently receiving benefits on your own Social Security record. Your annual income from Social Security will be reduced to 5320 from the total 14000 because 8680 of your benefits will be withheld. This is 447 of your final years income.

If you need to. Essentially the PIA is the sum of three parts of your AIME. For example if your Social Security payment is 1667 per month and you expect to receive 28960 in wages from your job the Administration would calculate that youll be over your earnings limit by 10000 and thus 5000 in benefits should be withheld.

Updated December 23 2020. The remaining states do not tax Social Security income. Benefit estimates depend on your date of birth and on your earnings history.

The maximum amount of Social Security benefits you can receive based on an ex-spouses record is 50 of what your ex-spouse would get at their full retirement age which varies based on their year of birth. Instead it will estimate your earnings based on information you provide. This reduction is known as the WEP PIA.

In 2021 if you have fewer than 30 work credits youll pay 471 per month for Part A. Youll pay 259 per month if you have between 30 and 39 credits. Lets say a single 68-year-old retired woman Susan receives the average Social Security benefit totaling 18516 for the year.

The wage base is adjusted periodically to keep pace with inflation. Want to know more. This spousal benefit amount is further reduced if you file before you reach your own full retirement age.

If you work and earn 80000 you have exceeded the. It was increased from 132900 to 137700 in 2020 and to 142800 for 2021. The table below shows how much a 1500 Social Security benefit could increase each month if you wait until your full retirement age to claim benefits.

So benefit estimates made by the Quick Calculator are rough. The Social Security Administration SSA publishes a chart that shows the maximum amount in dollars rather than percentages that your Social Security benefits would be reduced based on the number of. Your military service railroad employment or pensions earned through work for which you did not pay Social Security tax.

Any income above that is not counted in your benefit calculation and is also not subject to Social Security taxes. The average Social Security check in 2020 is 1503. In 13 states your Social Security benefits will be taxed as income either in whole or in part.

So they would withhold your benefit payment from January to March. The maximum possible Social Security benefit for someone who retires at. First the Social Security Administration SSA calculates the benefits owed on your own earnings record if you qualify.

It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your. While conventional wisdom says you dont have to. Social Security sets a cap on how much of your income it takes into account in figuring your benefit.

Heres how it broke down year by year from 2012 to 2021. Typically that means youve paid into Social Security for at least 10 years over the course of your life. For security the Quick Calculator does not access your earnings record.

As you approach retirement keep track of your expenses so you know how much income youll need to maintain your current standard of living. If You Claim Social Security at. Multiply 1984s earnings by this index factor to get 58423 which you see in Column F.

If you start collecting your benefits at age 65 you could receive approximately 33773 per year or 2814 per month. Social Security may provide 33773. In that case the WEP can reduce your Social Security payments by up to 50 of your pension amount.

The average Social Security benefit was 1543 per month in January 2021. Who Can Use the Retirement Estimator. You can use the Retirement Estimator if you have enough Social Security credits to qualify for benefits and you are not.

In 2021 the cap is 142800 its adjusted annually to reflect historical wage trends. Susan collected 30000 from other means throughout the. A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits.

All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax. Take 4488816 which is the average earnings for the year this person turned 60 2013 divided by 16135 to get the Index Factor you see in Column E.

Explore The Benefits You May Be Due

Explore The Benefits You May Be Due

Social Security Number For Immigrants And Visitors Citizenpath

Social Security Number For Immigrants And Visitors Citizenpath

My Social Security Online Account Access Center For Financial Planning Inc

/when-and-how-social-security-checks-should-arrive-2388919-v5-5b31507f8e1b6e00369bd83d-a2c1fa784cb04df3aa427f4206745d71.png) What Day Should My Social Security Payment Arrive

What Day Should My Social Security Payment Arrive

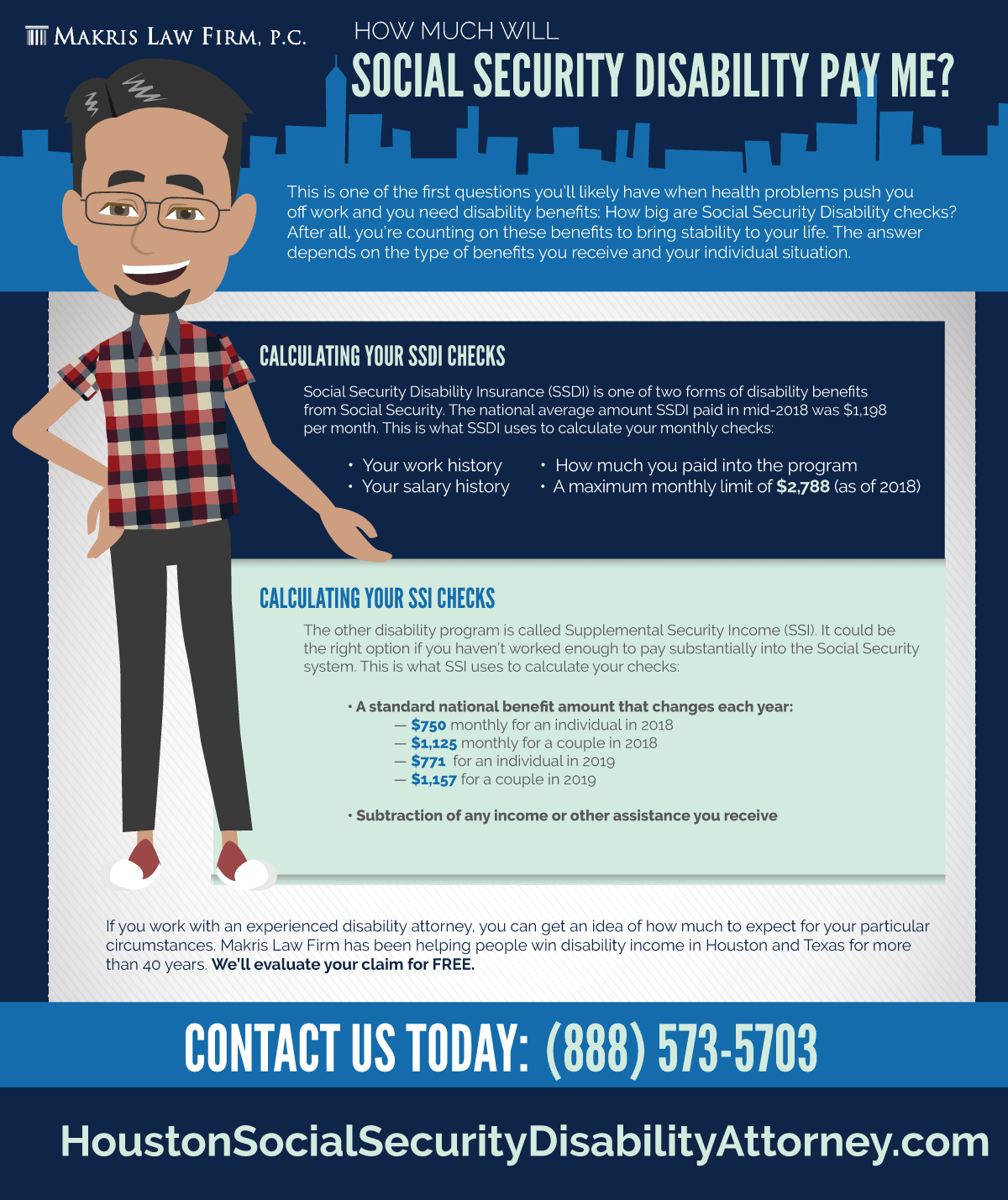

If I Win My Disability Case How Much Money Will I Receive Houston Social Security Disability Makris Law

If I Win My Disability Case How Much Money Will I Receive Houston Social Security Disability Makris Law

Find Your Social Security Number

Find Your Social Security Number

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Social Security Administration Now Requires Two Factor Authentication Krebs On Security

Social Security Administration Now Requires Two Factor Authentication Krebs On Security

How To Login My Social Security Account Social Security Benefits

How To Login My Social Security Account Social Security Benefits

How Does Social Security Work Top Questions Answered Ramseysolutions Com

How Does Social Security Work Top Questions Answered Ramseysolutions Com

When Are Medicare Premiums Deducted From Social Security

When Are Medicare Premiums Deducted From Social Security

Create An Account My Social Security Ssa

Create An Account My Social Security Ssa

How To Set Up An Online Social Security Account

How To Set Up An Online Social Security Account

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.