Based on this AIME amount and the bend points 996 and 6002 the PIA would equal 326270. The maximum monthly Social Security benefit that an individual can receive per month in 2021 is 3895 for.

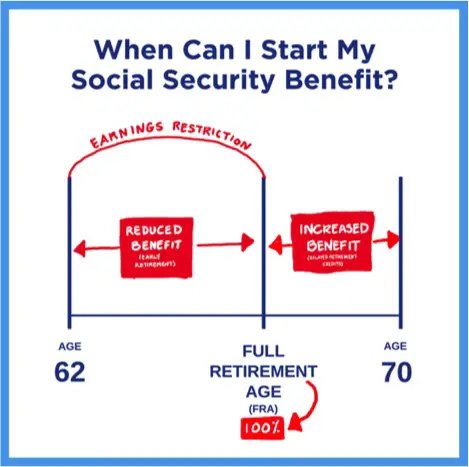

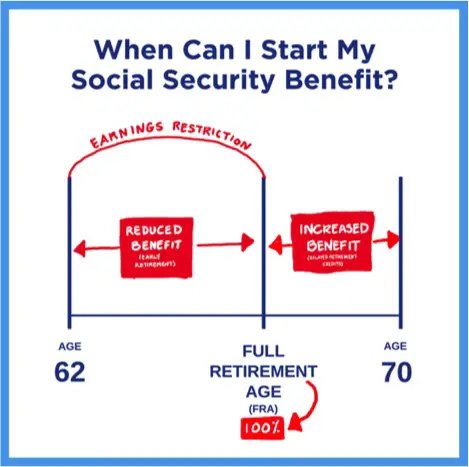

Remember FRA is no longer age 65.

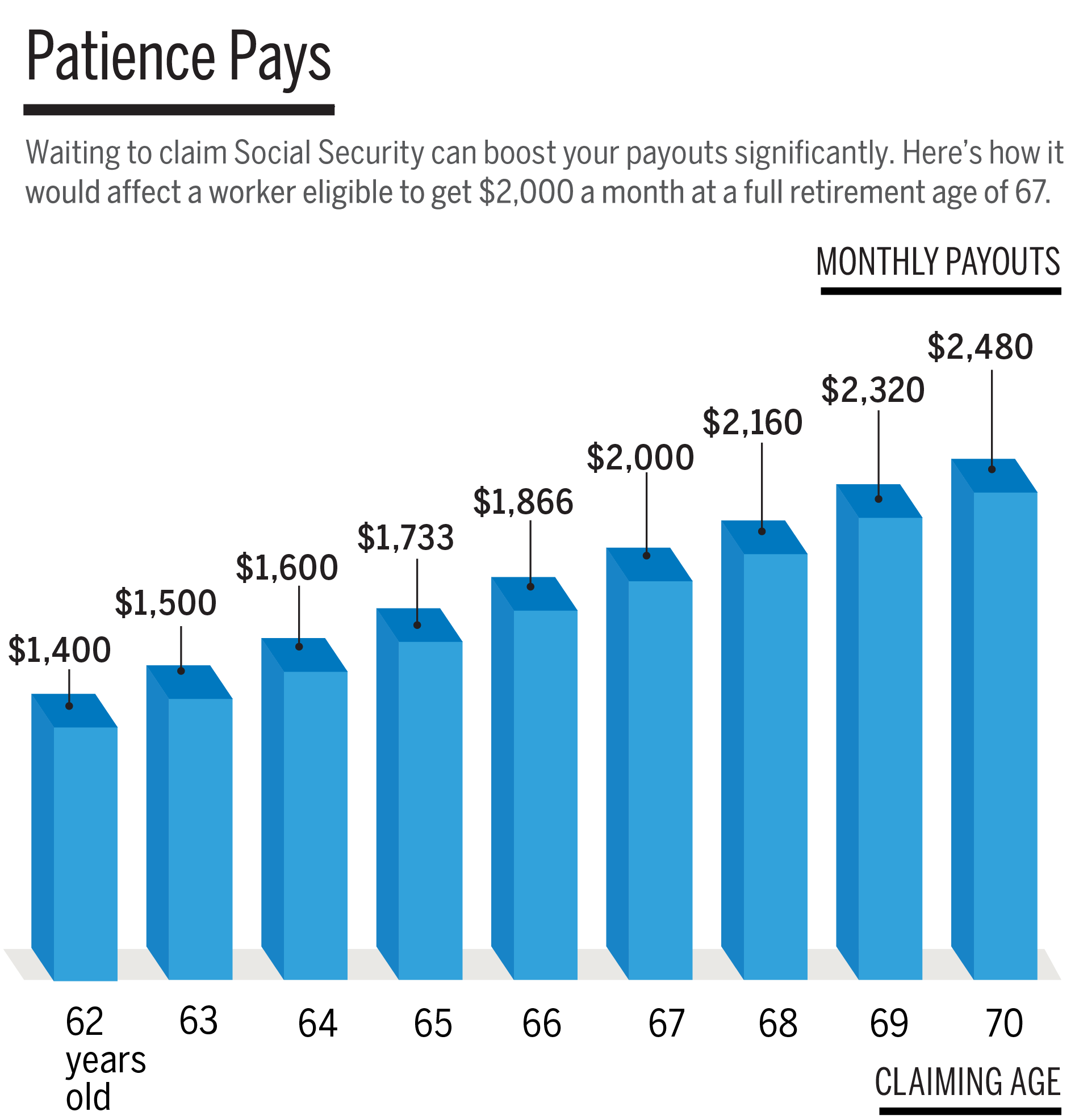

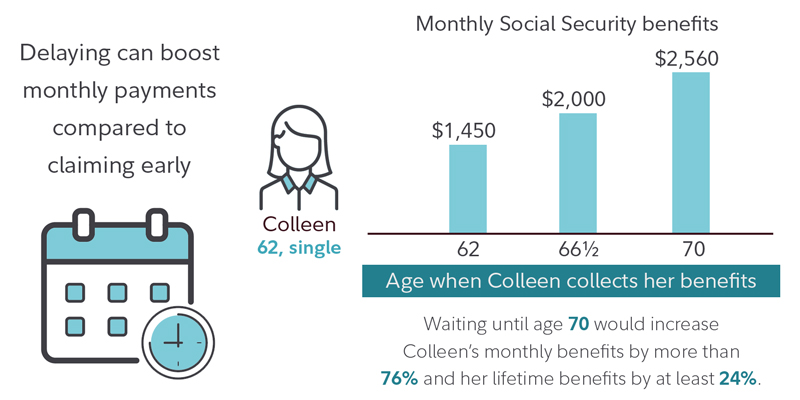

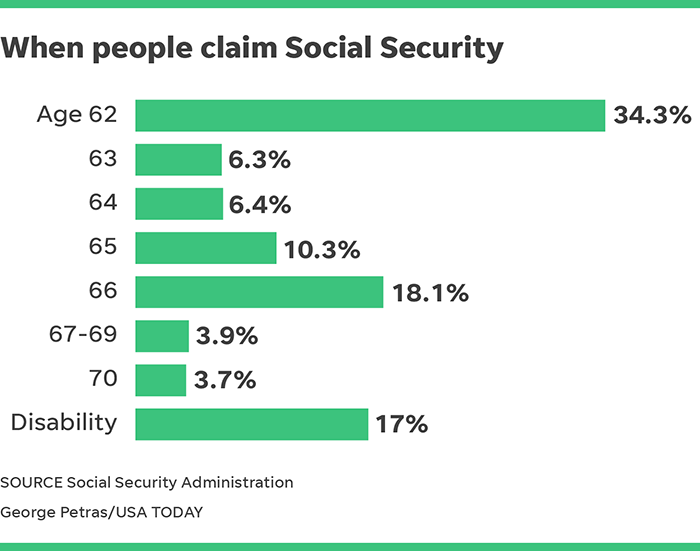

Social security amount at 62. And yet in 2018 only 6 of women and 4 of men waited until they turned 70 to claim benefits. If you were born in 1960 or later for instance filing at 62 could reduce your monthly payment by as much as 30 percent. Rosie is 64 years old.

However once your income exceeds that amount Social Security will hold back 1 for every 2 earned. A Real-Life Example of the Social Security Income Limit in Action. If you start benefits between the month you turn 62 and the month you reach full retirement age the Social Security Administration will deduct one dollar from your annual benefit amount for every two dollars you make above an annual limit.

For example a person who had maximum-taxable earnings in each year since age 22 and who retires at age 62 in 2021 would have an AIME equal to 11098. Take a look at Carols situation. In Nebraska more than 250000 retirees collect Social Security benefits that in 2020 will average 153362 per month or 1840344 for the year.

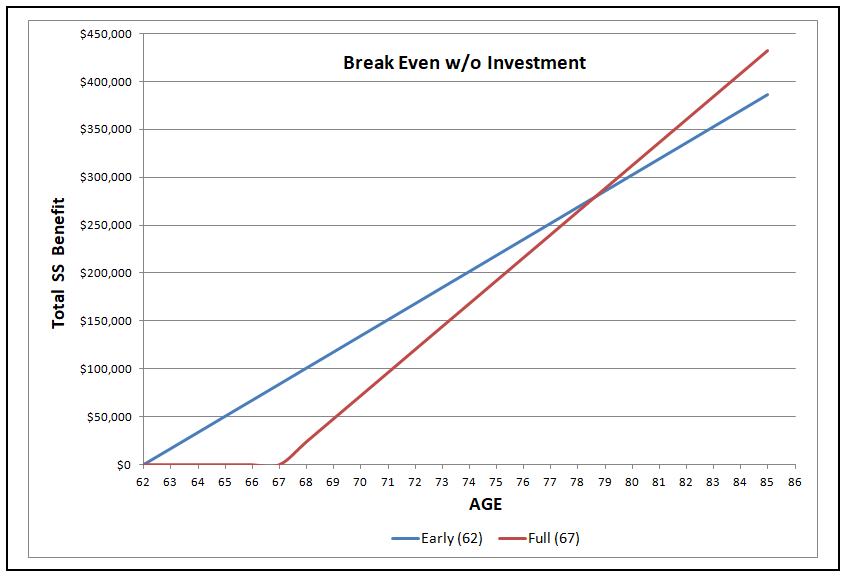

According to payout statistics from the Social Security Administration in June 2020 the average Social Security benefit at age 62 is 113016 a month or. If Carol lives to age 84 she can get varying amounts depending on whether she starts Social Security at age 62 66 or 70. My social security election age.

The maximum possible Social Security benefit for someone who retires at. For every 2 you earn above the cap your Social Security benefit is reduced by 1. If you start taking Social Security at age 62 rather than waiting until your full retirement age FRA you can expect up to a 30 reduction in monthly benefits with lesser reductions as you approach FRA.

Qualifying for Social Security at age 62 requires 10 years of work or 40 work credits. For example if your Social Security statement says you will get 1100 a month at age 62 that estimate assumes youll work until you turn 62 years old. Based on her birth year her full retirement age is 66.

To put these numbers into context lets look at an example of how this might work in a real-life scenario. 10 rows You must be at least 62 for the entire month to receive benefits. It now ranges from 66 to 67 depending on your date of birth see your full retirement age.

If your full retirement benefit is 1500 a month over 20 years that 1333 percent penalty adds up to nearly 48000. When you claim Social Security at 62 know that you are subject to a cap on wage income. You will receive 40982 in annual social security payments starting at age 66.

This means that if you decide to collect benefits at age 62. Should the spouse decide to take benefits as early as possible at age 62 that may reduce his or her benefit to less than one-third of the working spouses Social Security amount. This person would receive a reduced benefit based on the 326270 PIA.

To do the math multiply your monthly benefit amount times twelve months times the number of years expected to receive benefits. If your full retirement age is 67 and you claim Social Security at 62 your monthly benefit will be reduced by 30 percent permanently. The annual payment you receive from Social Security is based on your income birth year and the age at which you elect to begin receiving benefits.

Most advisers and financial columnists wag their. The average Social Security benefit was 1543 per month in January 2021. As of 2019 this limit is 17640 per year or 1470 a month.

She started taking Social Security benefits as soon as she turned 62. AARPs Social Security Benefits Calculator can provide more details on how filing early reduces benefits. File at 65 and you lose 1333 percent again permanently.

The amount of benefits your statement says you will get at age 66 or 67 assumes you work until your 66th or 67th birthday. By filing at 62 or any time before you reach full retirement age you forfeit a portion of your monthly benefit.

Social Security At 62 Or 67 Understanding All Potential Impacts Seeking Alpha

Social Security At 62 Or 67 Understanding All Potential Impacts Seeking Alpha

Breaking Down Social Security Retirement Benefits By Age Simplywise

Breaking Down Social Security Retirement Benefits By Age Simplywise

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

What Is The Best Age To Start Claiming Social Security Money

What Is The Best Age To Start Claiming Social Security Money

5 Social Security Questions Everybody Should Be Able To Answer Before Retiring Fedsmith Com

5 Social Security Questions Everybody Should Be Able To Answer Before Retiring Fedsmith Com

When Should You Start Social Security Benefits Do The Math Cbs News

When To Take Social Security Retirement Benefits

When To Take Social Security Retirement Benefits

University Of California Should You Take Social Security At 62

University Of California Should You Take Social Security At 62

Social Security At 62 Fidelity

Social Security At 62 Fidelity

Should I Claim Social Security At 62 And Invest It The Motley Fool

Should I Claim Social Security At 62 And Invest It The Motley Fool

Social Security Why The 8 Return Myth Shouldn T Make You Wait To Retire The Motley Fool

Social Security Why The 8 Return Myth Shouldn T Make You Wait To Retire The Motley Fool

What S The Most Popular Age To Take Social Security

What S The Most Popular Age To Take Social Security

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.