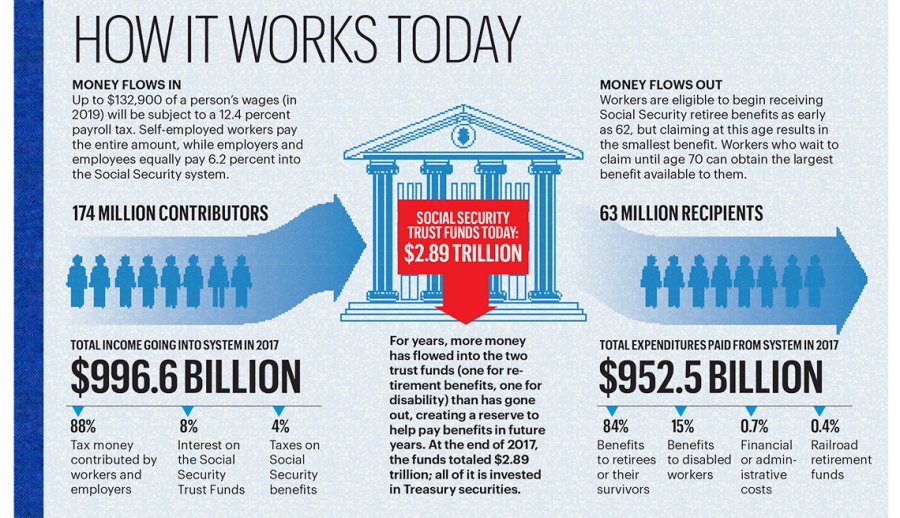

In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. Signed into law in 1935 the US.

Social Security Card Replacement Limits May Come As A Surprise

Social Security Card Replacement Limits May Come As A Surprise

Social Security is a financial safety net for millions of retired Americans.

On social security. Exclusions specified can be further divided into two categories. After receiving data from the Social Security Administration SSA in late March the IRS was able to start processing third stimulus payments for approximately 30 million seniors. A free and secure my Social Security account provides personalized tools for everyone whether you receive benefits or not.

Tax Tip 2020-76 June 25 2020 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement survivor and disability benefits. Social Security beneficiaries age 65 and younger can earn up to 18960.

You can use your account to request a replacement Social Security card check the status of an application estimate future benefits or manage the benefits you already receive. Social Security payments will increase by 13. At that point 58 of retirees said Social Security was a major source of income essentially the same as today.

Essentially the lower. But if you look at how the federal tax on Social Security is calculated youll notice that benefits arent taxed for most people who only have income from Social Security. If you have other sources of retirement income such as a 401k or a part-time job then you should expect to pay income taxes on your Social Security benefits.

Social Security is a program run by the federal government. Business Services Online Organizations businesses employers attorneys non-attorneys representing Social Security claimants representative payees and third parties can exchange information securely with Social Security. Social Security is much broader than just the benefits provided to retired workers.

By the Central government life and disability cover health and maternity benefits old age protection Education any other benefit determined by the. Here is a closer look at the various aspects of the Code and how its implementation can impact the take-home pay of an employee. While the intention of the Code on Social Security is to increase the retiral benefits of the employee this could impact the take-home salary.

For 2019 if you earn more than 25000 as an individual or 32000 as a couple filing jointly youll owe federal income taxes on your Social Security benefits including retirement benefits spousal benefits survivor benefits and disability benefits. The average Social Security check is expected to be around 1540 per month in 2021. Roosevelt in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs.

Social Security program was designed at one time to be a key provider of income for Americans who reached retirement age. The following types of welfare schemes are to be framed and notified. My Social Security Securely access information from your Social Security record including earnings history and estimates of your retirement disability and survivors benefits.

They dont include supplemental security income payments which arent taxable. The earnings subject to the Social Security tax will climb to 142800. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

Founded in the aftermath of the Great Depression this social insurance program was designed to pay out monthly. The simplest answer is yes. Social Security provides you with a source of income when you retire or if you cant work due to a disability.

In fact the Social Security Administration SSA provides an important source of retirement income for many Americans including the spouses ex-spouses widows widowers and dependent children of workers. An important element of Social Security is its disproportionate impact on retirees with lower incomes. In each of the past 17 years Social Security has topped the list of major sources of income for retirees.

The Nationwide survey polled people aged fifty or older with household incomes above 150000. Social security is a human right which responds to the universal need for protection against certain life risks and social needs. Thats because Social Security is only taxable above certain income levels.

The portion of benefits that are taxable depends on the taxpayers income and filing. However with an aging population. It can also support your legal dependents spouse children or parents with benefits in the event of your death.

The Code on Social Security 2020 The Code on Social Security aims at extending the benefits to non-traditional workers too. Effective social security systems guarantee income security and health protection thereby contributing to the prevention and reduction of poverty and inequality and the promotion of social inclusion and human dignity. The original Social Security Act was signed into law by Franklin D.

12 Facts About How Social Security Works

12 Facts About How Social Security Works

Is Your Social Security Benefit Higher Than The Average Payout The Motley Fool

Is Your Social Security Benefit Higher Than The Average Payout The Motley Fool

How Does Social Security Work The Motley Fool

How Does Social Security Work The Motley Fool

House Democrats Social Security Bill Is An Assault On Taxpayers Freedomworks

House Democrats Social Security Bill Is An Assault On Taxpayers Freedomworks

/GettyImages-1010183388-3cce3e4ccd4b44b2ac5efb8b48fc3d2d.jpg) 10 Common Questions About Social Security

10 Common Questions About Social Security

4 Unfortunate Ways You Could Miss Out On Social Security Benefits The Motley Fool

4 Unfortunate Ways You Could Miss Out On Social Security Benefits The Motley Fool

8 Social Security Services You May Not Know About

8 Social Security Services You May Not Know About

No You Won T Lose All Of Your Social Security Benefits

No You Won T Lose All Of Your Social Security Benefits

Faq Home Customer Self Service

Faq Home Customer Self Service

Social Security Administration Wikipedia Bahasa Indonesia Ensiklopedia Bebas

Social Security Administration Wikipedia Bahasa Indonesia Ensiklopedia Bebas

Social Security Socialsecurity Twitter

Social Security Socialsecurity Twitter

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.