And you might consider the costs of long term care. Ad Enjoy up up to 10 profits per week with the best investment platform 2021.

This Is The Right Amount Of Stocks To Own At Every Age Money

This Is The Right Amount Of Stocks To Own At Every Age Money

Everything you spend money on in a month needs to total 2100 or less in this example anyway.

Investing after 70. But under the new law there are no age restrictions. Contributing to a traditional IRA which may offer a deduction on contributions as well as tax deferral on investment gains. Reverse mortgages become worthy of consideration at age 70 and beyond also.

Our members enjoy thorough support and up to 10 profits each week from their investments. Our members enjoy thorough support and up to 10 profits each week from their investments. Ad Enjoy up up to 10 profits per week with the best investment platform 2021.

Jones not their real names from Qualicum. Actually most 75 year olds invest the same way as 65 year olds just a little more cautious. For years the RMD age was 70½.

Retirees have to juggle finding safe investments to protect their income streams while not being so safe they risk running out of money. With rates scraping bottom and lifespans lengthening a 100000 investment in a joint-life immediate annuity will return 475 per month to a 66-year-old. A reverse mortgage can be an option that provides you with guaranteed income and no risk.

Let me tell you a story about Mr. People younger than 705 have another option. They have s good income coming in from pensions about 30000 total per year.

Is appropriate for your timeline usually 30 to 40 years. With no debts and no major expenses they had about 200000 to invest. 7 There is also no age.

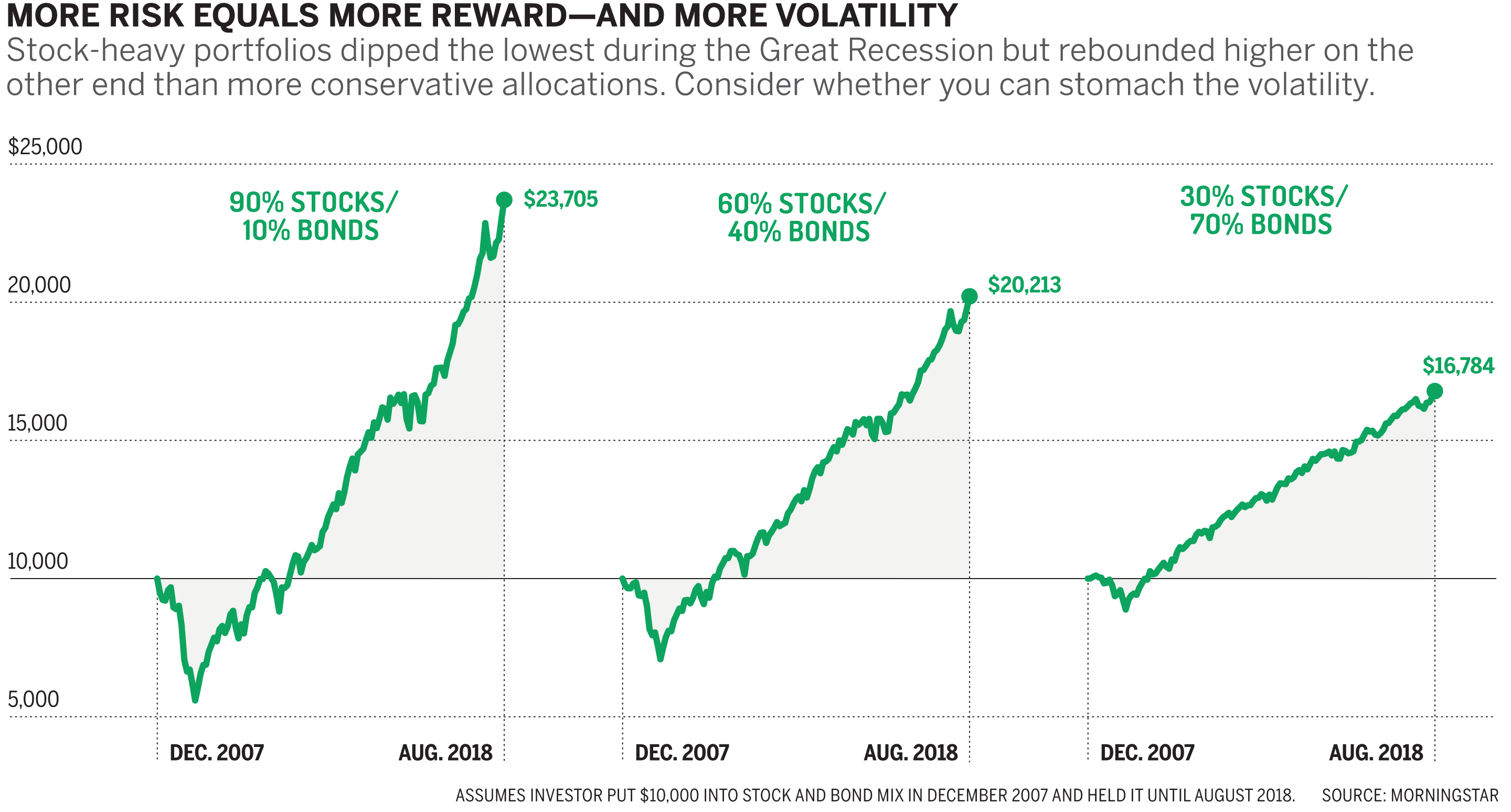

For most people your investing approach in retirement should be the same as it was all alongto determine an appropriate asset mix and then stick with it. So clearly investing nearly all. It used to be the case that if you were older than 70½ you lost the ability to contribute to a traditional IRA.

70 of 3000 is 2100 3000 x 7 2100. After all since that missive was released in March 2014 stocks have returned nearly 60 while the broad taxable bond market has returned just a bit over 8. A reverse mortgage can allow you to use the equity in your home for income while remaining in your home for as long as you want.

To become rich after 70 youll need to invest a lot of money every month and pray for good returns. Investing after retirement is anything but straightforward. Find 70 of that take-home income.

James Twining founder of Financial Plan in Bellingham Wash has run the numbers. 2019 bumped it up to reflect increased life expectancies. The SECURE Act which became law in Dec.

You can make your adult child the successor trustee if something happens to both of you. Depending on the amount of the money you could buy a combination lifelong term care insurance policy to help in that regard. Clients who are still working after age 70 ½ may generally continue contributing to employer-sponsored 401 k accounts and SEP IRAs.

That means you need a balanced portfolio of stocks bonds and cash investments that. In fact employers must continue to make employer contributions. That includes mortgage bills fun spending insurance utilities eating out.

You now have until age 72 to start taking RMDs from your.