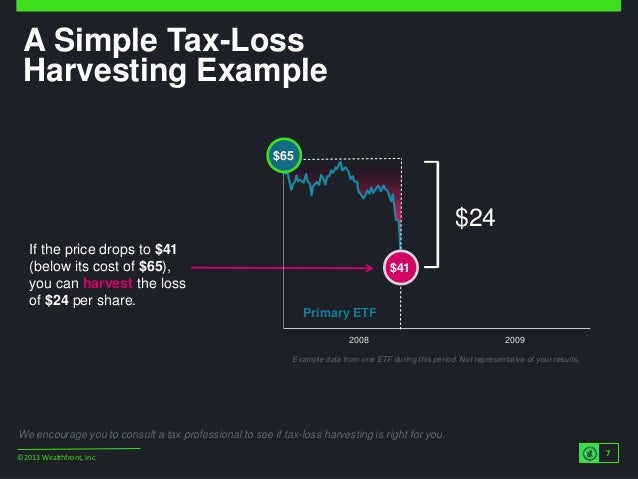

As a strategy tax-loss harvesting involves selling an investment that has lost value replacing it with a reasonably similar investment and then. Tax-loss harvesting is a strategy where capital losses are set off against capital gains to reduce taxable profits.

How Tax Loss Harvesting Can Save You Taxes This Year

How Tax Loss Harvesting Can Save You Taxes This Year

When you invest in equity markets your assets can either make capital gains or incur capital losses.

How does tax loss harvesting work. You can use tax-loss harvesting to offset capital gains that result from selling securities at a profit. Tax-loss harvesting is a strategy in which certain investment assets are sold at a loss in order to reduce your tax liability at the end of the year. Tax loss harvesting referred as Tax loss selling is a strategy used by the taxpayer to offset the liability related to capital gain tax arises on sale of securities either short term or long term securities by selling the securities at loss and it generally limits the recording of short term capital gain as it is taxed at a rate higher than.

At the beginning of. How Tax-Loss Harvesting Works Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income. Tax loss harvesting is when you sell some investments at a loss to offset gains youve realized by selling other stocks at a profit.

How Does Tax Loss Harvesting Work. In tax-sheltered accounts such as 401ks and IRAs this isnt applicable because you dont pay taxes on investment earnings within tax-sheltered accounts. Tax Loss Harvesting is a popular strategy wherein the loss-making securities are sold in order to reduce the tax liabilities arising on account of gains made in the other securities.

Mary is in the 24 tax bracket. Harvesting tax losses involves selling an investment at a loss to offset other taxable gains thus lowering your taxes. You can also use tax-loss harvesting to offset up to 3000 in non-investment income.

Capital gains from your investments are taxed as short term capital gains 15 and long-term capital gains 10. This only works in taxable accounts. Tax-loss harvesting is the process of selling investments for less than you originally paid to offset taxable gains elsewhere.

The basic rationale behind this is to offset capital gains against capital losses by selling those investments which are having unrealized losses thereby reducing tax liability. One useful thing you can do with your portfolio during market declines is check your taxable accounts for opportunities to tax-loss harvest. How does it work.

Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return. By selling poorly performing investments at a loss you can use the revenue generated from the sale to offset your capital gains thus allowing you to pay fewer taxes. Tax law its usually possible to offset your capital gains with capital losses youve incurred during that.

The funds are then used to purchase a comparable investment in the hopes that it will increase in value over time resulting in a capital gain. How Does Tax-Loss Harvesting Work. Yes it can with tax-loss harvesting strategy and heres how it works.

Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. Tax-loss harvesting does not apply to IRAs or other tax-sheltered accounts To explain what tax-loss harvesting is lets look at an example. Typically an investment is sold at a loss with the proceeds being used to purchase a similar but not substantially identical investment in order to maintain market exposure.

How does tax-loss harvesting work. At its most basic tax-loss harvesting involves intentionally selling poorly performing investments for a loss and reinvesting the proceeds back into the market. In its purest form tax-loss harvesting is designed to save you money on your realized taxes today and possibly in the future.

This has gained momentum since April 2018 when long term capital gains on the sale of stocks were made taxable at 10 percent over and above Rs1 lakh. When you sell an asset at a profit the capital gains on the asset are realized and that amount is liable for taxation. How Does Tax Loss Harvesting Work.

Tax-loss harvesting applies only to investments owned within taxable accounts not retirement accounts like 401 ks or IRAs.

:max_bytes(150000):strip_icc()/forensic-psychologist-career-profile-974489-Final-5f092a82158e4eedbafe8c69990f6c3e.png)