There are several ways to pay off one credit card Card A with another Card B. Credit card providers dont allow you to pay off your debt simply by charging it to another card.

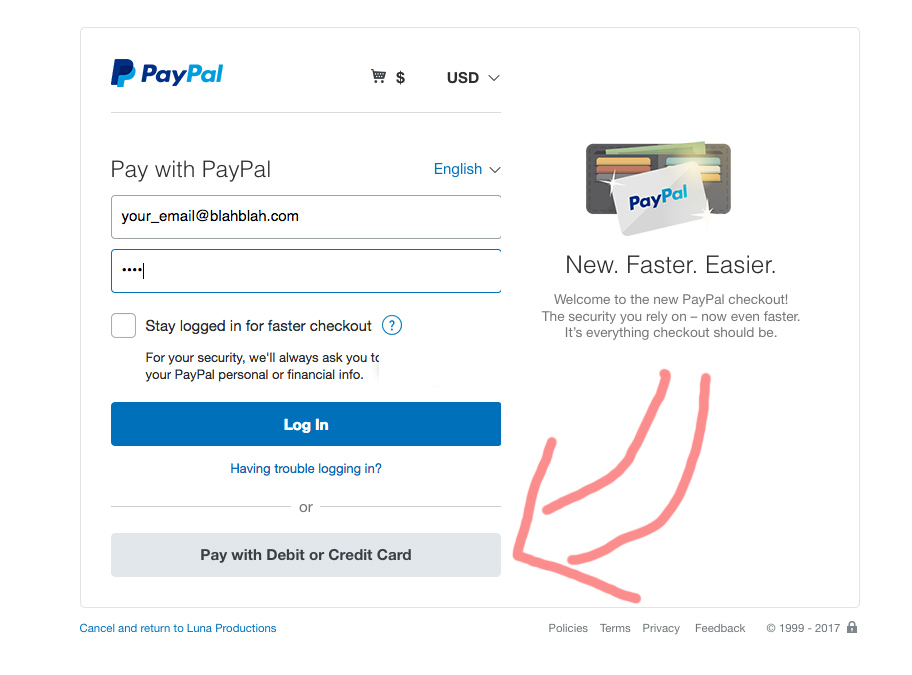

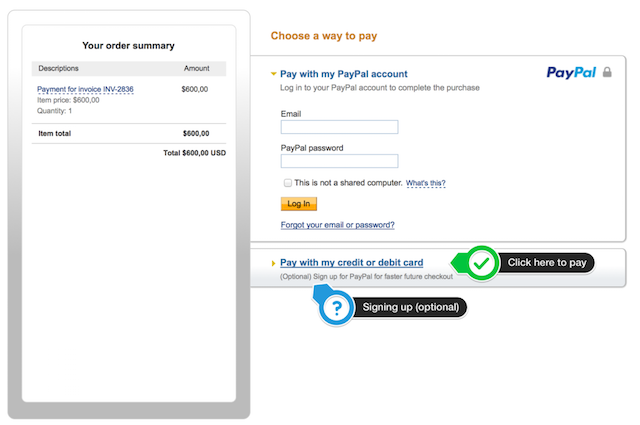

How To Pay By Credit Card Without A Paypal Account

How To Pay By Credit Card Without A Paypal Account

However using a credit card with the over limit option is subject to terms and conditions.

Can you pay a credit card with a credit card. But if you do want to use a credit card to pay for another credit cards bill you can do that indirectly. But there is an indirect way to pay off this debt with another credit card. Unlike most monthly bills credit card payments give you the ability to decide your payment amount letting you pay multiple ways.

One option is to take a cash advance from Card B and then use the cash to make a payment to Card A. One thing that credit card issuers have in common though is that they wont let you pay your credit card bill with a different credit card. At least not directly.

You may be able to pay your credit card bill with a money order but very few issuers of money orders accept credit cards as payment. For some using a credit card to pay a mortgage is a way to avoid making a late payment. Paying taxes with a credit card can have a negative impact on your credit score.

No matter the method you choose to pay its important to understand your bill and how to pay it before it comes due so you dont risk missing a payment and hurting your credit. Golden says credit card companies typically will. Paying with a credit card but incurring fees between 196 and 199 of the total amount you owe The IRS doesnt accept debit or credit card payments directly but rather requires you to use one of.

If its not a large overpayment then you may just want to use it by continuing to make. You wont be able to pay off your credit card with another credit card and depending on your situation a balance transfer may be your best bet. Basically credit card issuers give you both options - to transact beyond the credit limit as well as decline the transaction when crossing the credit limit - you can hence opt in or opt out of over limit transactions at the time of paymenttransaction.

When youre ready to make a payment on your credit card youve got a few options. When you open a credit card its issuer may offer you several options to pay your bill including automatic deposits from a bank account. Citibank credit card has been added as the utility biller for several banks like HDFC Bank ING Vysya Bank State bank of India IndusInd bank Yes bank etc.

You can pay bills with a credit card as long as the entity youre paying allows it and many do. But this is only advisable if your cash flow. Paying bills with a credit card can streamline your bill-pay process plus you might be able to earn rewards.

The easiest way to pay down credit card debt. Charging high tax payments to a credit card can cause a spike in your credit utilization rate which is the total. Select the option of credit card payment.

The short answer is no says Paul Golden director of media relations for the National Endowment for Financial Education in Denver. By paying your cards off you will immediately decrease your credit utilization down to zero and get access to 100 of your available credit. Pay the amount outstanding for the Citibank credit card.

In most cases the only way to move debt from one credit card. That said to avoid costly interest payments on bills try to pay off your credit card balance in full each month. Thats because theyre concerned.

The right way to pay your credit card depends on your budget and financial goals and you might even switch up strategies month-to-month. Since credit utilization counts for 30 of your FICO score and is second only to paying your bills on time your score should see a fairly immediate jump. If youve ever wondered how you can rack up more credit card rewards you may have asked yourself the question Can you pay a credit card with a credit card The short answer is no at least not in that way.

Technically you can pay a credit card with a credit card but whether or not you should is an important question. There is no direct way of paying one credit card bill through another credit card. With a credit card you get a short-term interest-free loan.

Your two best options after overpaying a credit card are to use the credit balance or request a refund. The short answer is no. There are 3 methods by which you could use your credit card to pay another credit cards bill.

Before making a payment youll need to review your credit card bill to understand how much you. How to Make Your Credit Card Payment.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/2802590/20141220153327.0.jpg)