If youre self-employed or have two jobs you can contribute to 401 k accounts for each one. Depending upon your employer you may also have a 457 generally only available to governmental units with a separate annual limit available to you.

How Much Money Do I Need To Retire Infographic

You are only allowed to roll over IRA accounts once every 12 months.

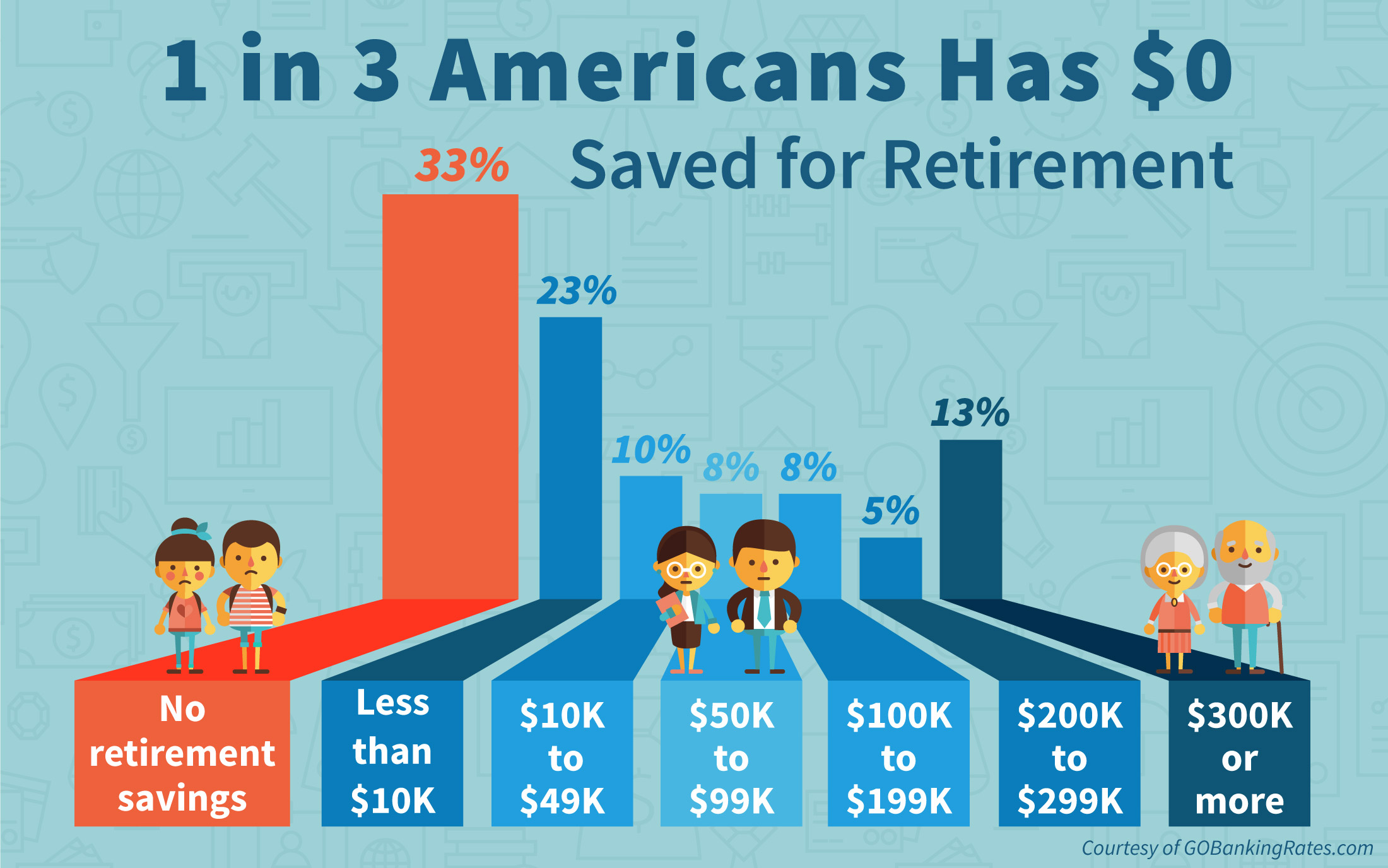

How many retirement accounts can i have. In fact recent research from the Aspen Institute suggests the majority of Americans dont have one. Choose the calculator you like. And with his help find out how many retirement accounts can i have.

Can You Have More than one 401k Account. This makes it easier to diversify your retirement holdings and maintain easier control over your account administration. It is allowable to own all of those different accounts.

Non-qualified investments may also be a great option if you have already maxed out the amount you. How many Roth IRA accounts can I have You can have more than one Roth account. In fact with respect to IRAs and Roth IRAs you can split those into as many separate IRA or Roth accounts as you would like.

Many physicians have access to a 403b by working for a hospital or public entity. Its possible then to have multiple IRAs for retirement savings. To do this you need to write in the search box for example google how many retirement accounts can i have and add to it an additional word.

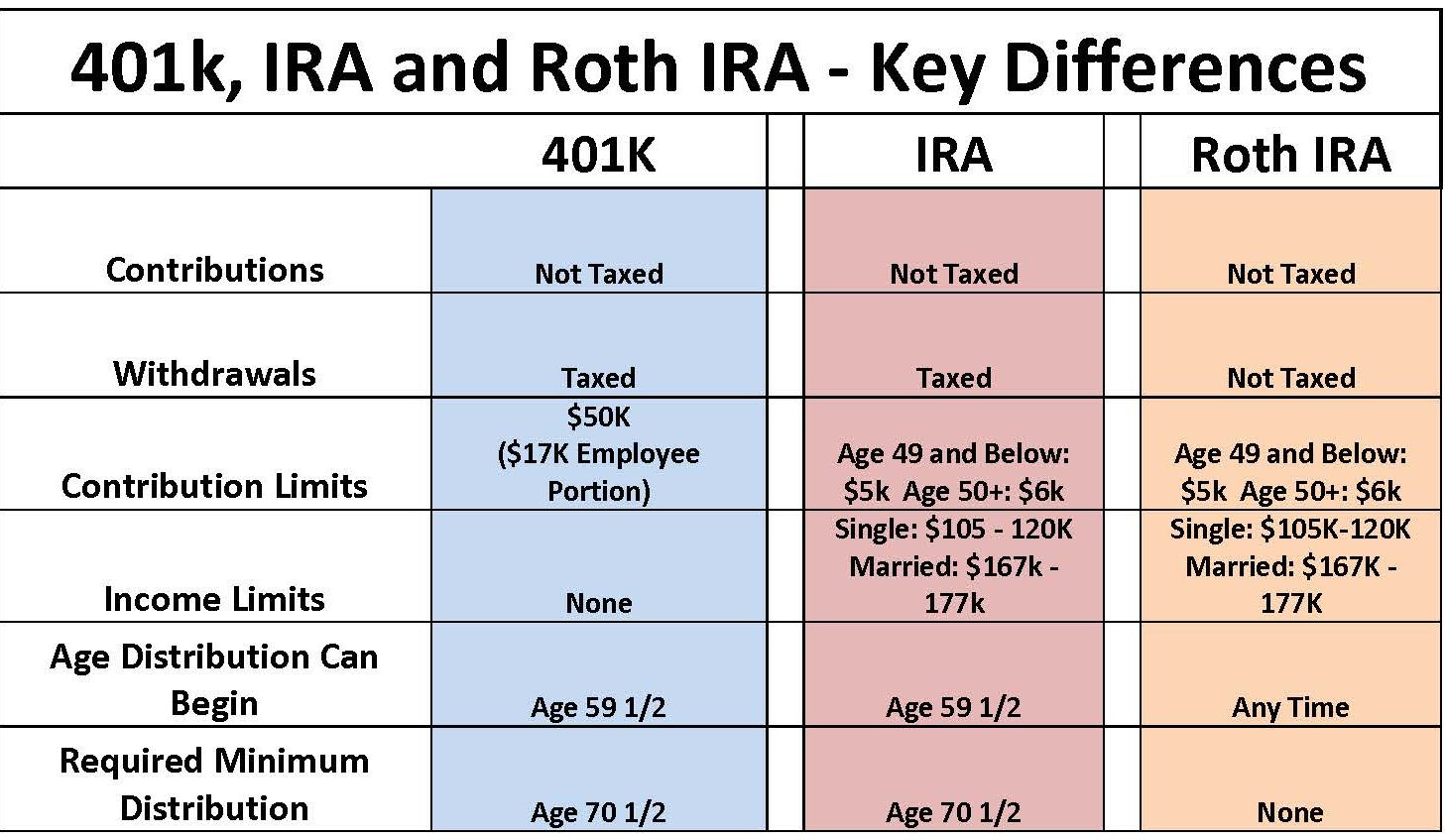

No matter how many accounts you have though your total contributions for 2020 cant exceed the annual limit of 6000 or 7000 for people age 50 and over. The government treats a SEP IRA as a traditional IRA for tax purposes. There is a unique rule for 403bs however which will prevent many doctors who use a 403b at their main job from maxing out an individual 401k on the side at least if they own 50 or more of the company for which they have an individual 401k and they probably do.

If you have both a traditional IRA and a Roth IRA you cant. Ask Ed Slott Confused about IRAs 401ks Roths taxes and more related to saving for retirement. With a 401k there is no limit to how many times you can roll them over but your employer must.

This is shocking news and its a big problem if youre one of those Americans going without. However the total amount of your contributions still must not exceed the maximum contributions for any year. Converter or calculator.

Here are tips for maximizing your IRA contributions each year. At the touch of a button you can find out how many retirement accounts can i have. How your 401k works after retirement depends in large part on your age.

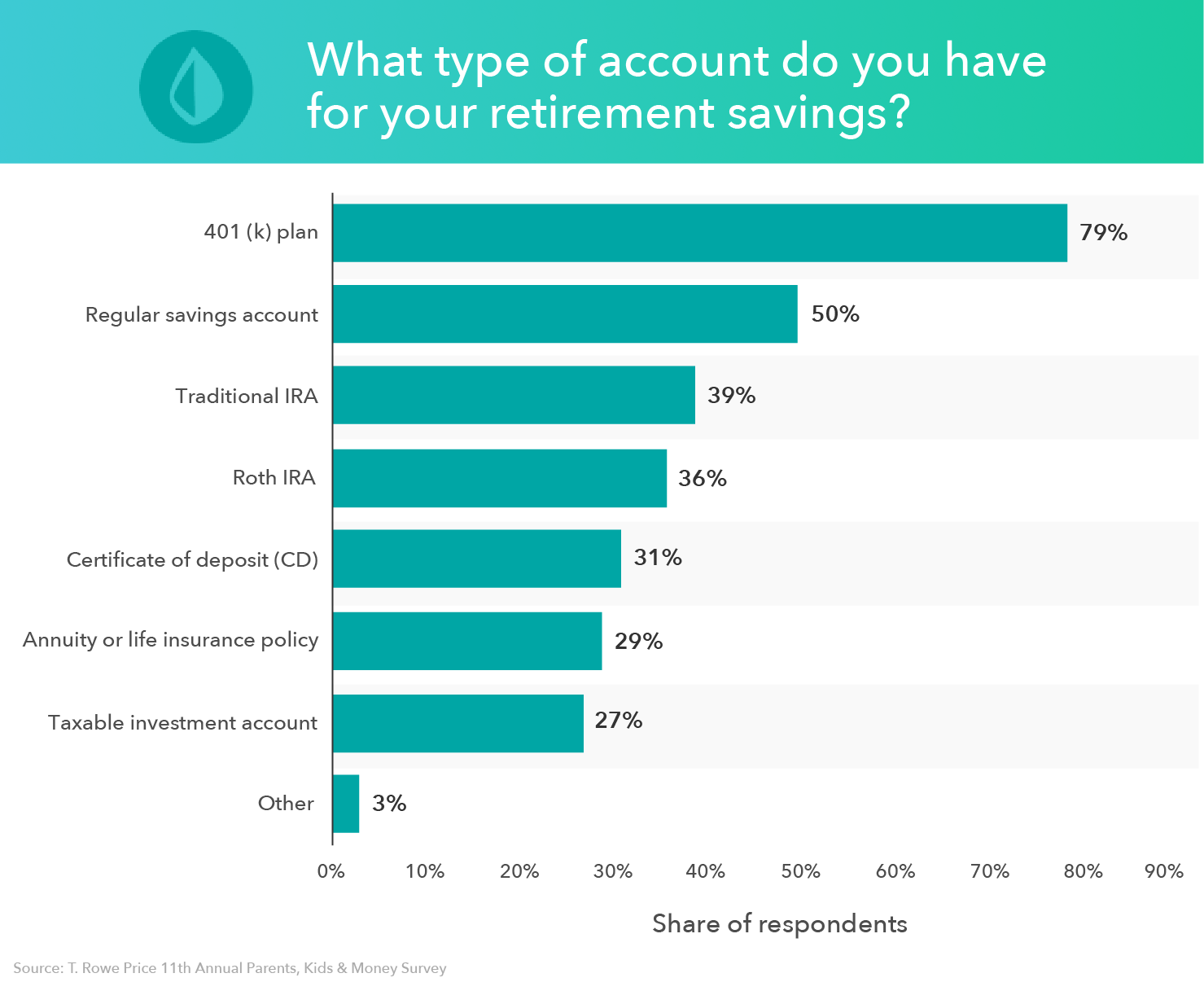

Theres no limit to the number of individual retirement accounts IRAs you can own. Regarding mixing Roth IRA and traditional IRA either deductible or nondeductible you have only one annual contribution limit available to you for all IRA contributions. Workers can contribute up to 5500 to an individual retirement account in 2016 and the limit jumps to 6500 for people age 50 and older.

37000 Age 45 - 55. Whether you have one IRA or six you still cant contribute more than the annual limit 5500 for 2018 to all your accounts combined. How Many IRAs Does the IRS Allow.

82600 Age 55 - 64. While these accounts dont enjoy the same tax benefits as qualified accounts like 401ks or IRAs they also dont have as many restrictions. Median retirement account.

Rule 7 403bs Are Not 401ks. The IRS doesnt cap the number of IRAs any individual can have open at once time. Yes you can name different beneficiaries for each of your Roth accounts.

If you retire after 59½ you can start taking withdrawals without paying an early withdrawal penalty. You can also have one IRA account with multiple investments within the account. You will have more flexibility to access your savings prior to retirement.

For example if youre self-employed you might have a SEP IRA which allows you to make contributions as both an employer and an employee. You can have more than one 401 k account as long as the total contributed to those accounts in any given year does not exceed 19500 or 26000 for ages 50 or older.

What Is An Individual Retirement Account Ira Nerdwallet

What Is An Individual Retirement Account Ira Nerdwallet

Why Having Too Many Retirement Accounts Can Ruin Your Retirement Plan Retirement Matters

Why Having Too Many Retirement Accounts Can Ruin Your Retirement Plan Retirement Matters

Square Measure You An Ira Hoarder Total You For In The Direction Of Be Read Most Owning Manifold Ira Accounts How Many Ira Accounts Can I Have

Square Measure You An Ira Hoarder Total You For In The Direction Of Be Read Most Owning Manifold Ira Accounts How Many Ira Accounts Can I Have

Fellow Turn Over Happening How Many Retirement Accounts Can One Person Have

Fellow Turn Over Happening How Many Retirement Accounts Can One Person Have

Why Having Too Many Retirement Accounts Can Ruin Your Retirement Plan Retirement Matters

Why Having Too Many Retirement Accounts Can Ruin Your Retirement Plan Retirement Matters

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

How Much Can I Contribute To My Retirement Accounts Marotta On Money

How Many Retirement Accounts Can You Have Cash Money Life

How Many Retirement Accounts Can You Have Cash Money Life

Should You Have Multiple Iras What To Know Smartasset

Should You Have Multiple Iras What To Know Smartasset

Saving For Retirement With A Retirement Planning Budget Mint

Saving For Retirement With A Retirement Planning Budget Mint

Retirement Accounts And Tax Benefits Arizona Tax Advisors

Retirement Accounts And Tax Benefits Arizona Tax Advisors

How Many Retirement Accounts Can You Have Cash Money Life

How Many Retirement Accounts Can You Have Cash Money Life

How Many Retirement Accounts Should You Have Why More Isn T Necessarily Better

How Many Retirement Accounts Should You Have Why More Isn T Necessarily Better

Keep I Bang Additional Than Joined Ira How Many Retirement Accounts Can I Have

Keep I Bang Additional Than Joined Ira How Many Retirement Accounts Can I Have

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.