If the agreed-upon purchase price in your sales contract exceeds the appraisal amount the simplest way to push the deal through is to drop the contracts purchase price to match the appraisal. I guess if the seller does not wish to lower price to meet the appraisal than I can walk away but will i lose out what I have invested.

What Happens If My Appraisal Comes Back Under Contract Price Riverfront Appraisals

What Happens If My Appraisal Comes Back Under Contract Price Riverfront Appraisals

A low appraisal is bad news because the lender will only provide a loan up to the appraised value overriding your agreed-upon purchase price.

What if house doesn t appraise for sale price. My contract did include contigiant claus that house must appraise or deal can be broken. If so Sam Heskel CEO of Nadlan Valuation Inc recommends a value appeal. I am putting 20 down plus paying for my closing cost.

Appraisal is lower than the offer. If the house you are purchasing doesnt appraise you have a couple of options. Lower the sale price to the appraised value.

Now if its a good appraisal and shows true market value some sellers will come down in price. If the comps support the sellers asking price but the FHA appraisal still comes in low then the home appraisal might be inaccurate. So what happens if the home youre buying doesnt appraise.

Heres what you can do if your home doesnt appraise for the sales price. If the person buying your house is financing this purchase the buyers lender will order an appraisal to ensure the house is worth the amount the bank is agreeing to finance for the buyers mortgage. If the comps support the appraisers lower estimate then the seller might be asking too much.

There may be and probably are other purchase deals pending that would help but they have not closed yet so they dont count. Those decisions could result in the deal moving forward or falling off the tracks. If the home appraises for less than the agreed-upon sale price the lender wont approve the loan.

Maybe the appraisers estimate of the homes value was inaccurate. Should the home fails to appraise for its contracted purchase price the contingency clause allows buyers to re-evaluate and potentially walk away. If the home will not appraise for the purchase price it means the lender will not agree to lend a high loan-to-value balance.

Absent a Magic 8-Ball that shakes out an answer to this question the appraisal step of your home sale can feel like a total wild card. By the way if your house does not appraise for the purchase price that does not mean that it is not worth what you are paying for it it just means that the appraisal mechanics did not come back with a supporting value. Secondly you can renegotiate the sales price but this can be tricky since the seller has already mentally spent the proceeds.

Going back to the example provided earlier who covers the 10000 discrepancy between your offer of 390000 and the appraisal of 380000. Typically the appraisal comes in right around the sellers listing price but sometimes you wind up with a low appraisal. Every once in a while the parties to a transaction will agree on a sale price of a home and the appraisal comes back lower than that price.

The best offer to accept is the offer that is likely to close escrowwhich means it might not be the offer with the highest sale price. Youve contacted the appraiser see the end of this post but the data andor sales information you. What happens if my home doesnt appraise for the selling price If your home doesnt appraise for the selling price you and the buyer will both have to make some decisions.

In this situation buyers and sellers need to come to a mutually beneficial solution that will hold the deal together more on that later. First you can terminate the contract and not purchase the house. Of course if the offer is cash there typically is no appraisal.

What if the appraisal is lower than purchase price. There are some potential complications to this approach. If a home doesnt appraise for its sale price youll either have to lower the price to the appraised value or ask the buyer to.

The house appraised approximately 1000000 lower than my offer. Appraisal contingencies are also sometimes used to renegotiate or exit contracts after an appraiser identifies required repairs such as chipped paint or cracked windows. Its usually best to walk away from a deal where the homeowner is asking too high a price for the house.

Asking the seller to reduce the contracted price to the appraised price is the first option most buyers try. The buyer could pay the difference out of pocket which doesnt happen very often.

My Home Appraisal Came In Too Low Now What

My Home Appraisal Came In Too Low Now What

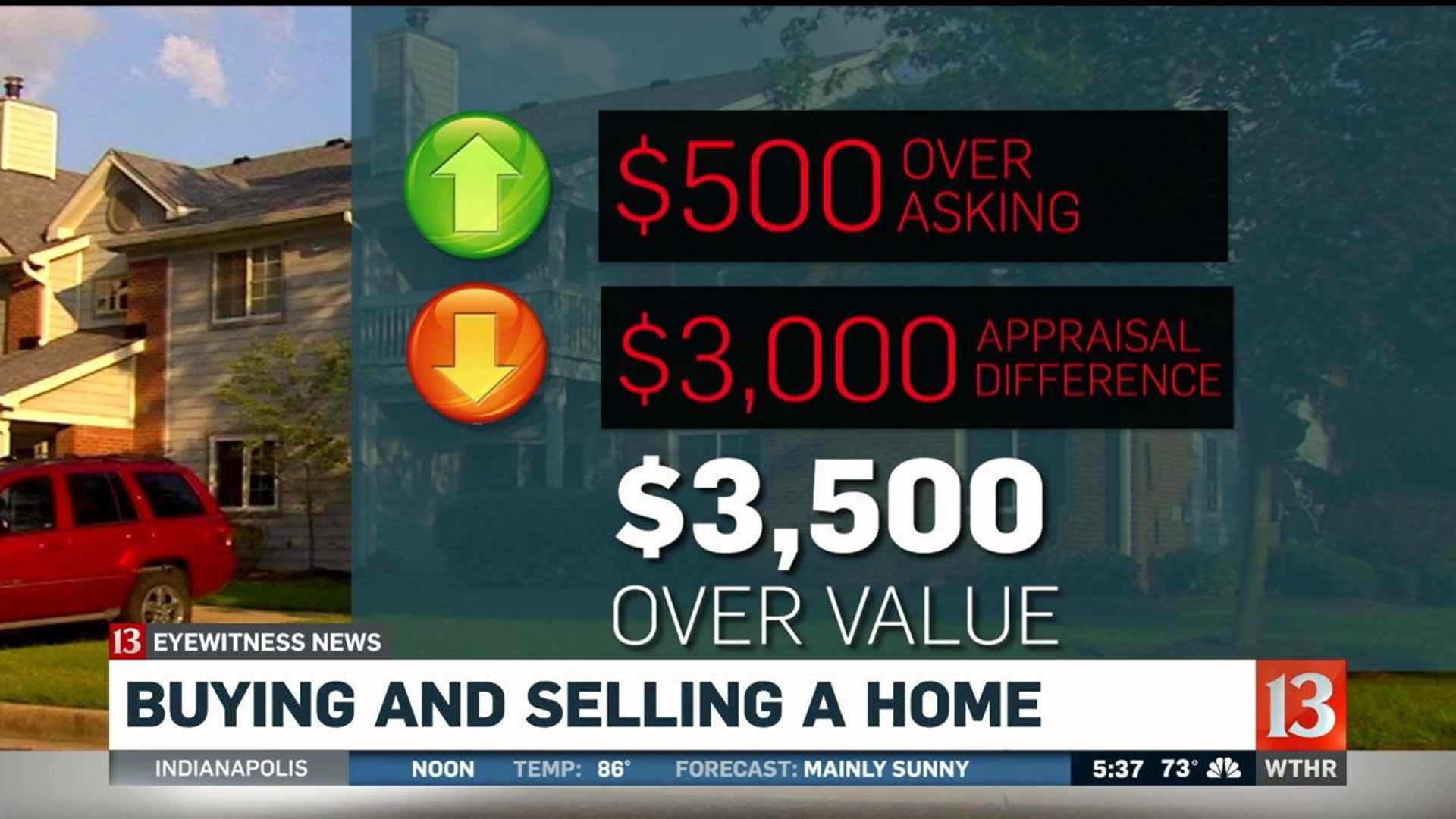

What To Do When Your Home Appraisal Doesn T Match The Sale Price Wthr Com

What To Do When Your Home Appraisal Doesn T Match The Sale Price Wthr Com

:max_bytes(150000):strip_icc()/how-to-deal-with-a-low-appraisal-1798414-finalv2-ct-2749c7a7868c442c8926425773e62027.png) How To Deal With A Low Appraisal

How To Deal With A Low Appraisal

/cost-of-home-appraisal-4140175_final-f62e0a7e93fe4a2491fc485b9a872933.png) Cost Of Home Appraisal When Buying A Home

Cost Of Home Appraisal When Buying A Home

What To Do When Your Home Appraisal Doesn T Match The Sale Price Wthr Com

What To Do When Your Home Appraisal Doesn T Match The Sale Price Wthr Com

What If My House Doesn T Appraise For The Purchase Price Trelora Real Estate

What If My House Doesn T Appraise For The Purchase Price Trelora Real Estate

5 Things To Do If A Home Appraisal Comes In Under Your Sales Price

5 Things To Do If A Home Appraisal Comes In Under Your Sales Price

The Appraisal Came In Low Now What Zillow

The Appraisal Came In Low Now What Zillow

/what-happens-after-a-home-buyer-s-offer-is-accepted-1798286_final-ea24b0329f724d86b39142c7fdbcecbb.png) What Happens After A Home Buyer S Offer Is Accepted

What Happens After A Home Buyer S Offer Is Accepted

What To Do When Your Home Doesn T Appraise At Its Purchase Price Century 21 Advantage Gold

/pricing-houses-to-sell-1798968_V2-3943d542fc624ff7abe7b7161322fcf0.png) Some Tips On How To Price Your Home For Sale

Some Tips On How To Price Your Home For Sale

The Appraisal Came In Low Now What Zillow

The Appraisal Came In Low Now What Zillow

My Home Appraisal Came In Too Low Now What

My Home Appraisal Came In Too Low Now What

Your Dream Home Appraised Lower Than Your Offer Now What

Your Dream Home Appraised Lower Than Your Offer Now What

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.