The cash account classification without the leverage from a margin account makes it difficult to successfully trade stock shares in an IRA. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

What Is An Individual Retirement Account Ira Robinhood

What Is An Individual Retirement Account Ira Robinhood

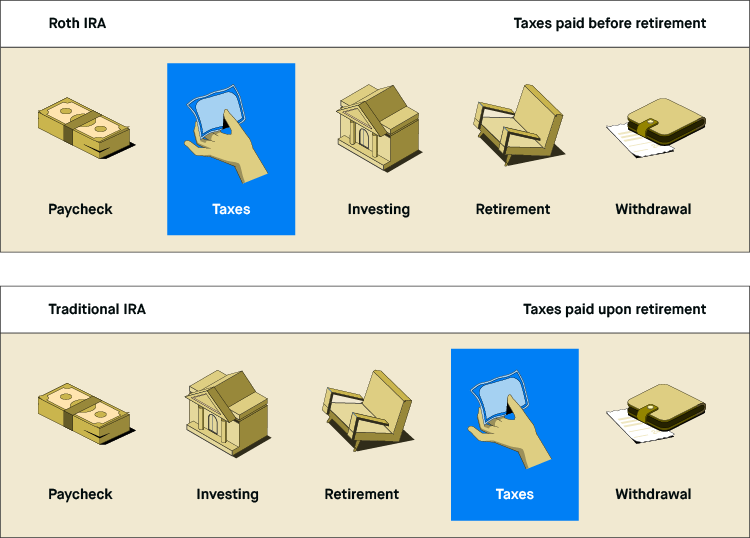

An individual retirement account IRA is a retirement savings account that can be used to hold investments in a tax-efficient manner.

Ira stock account. Individual retirement arrangements also referred to as individual retirement accounts or IRAs are tax-advantage investment accounts that allow taxpayers who have earned compensation to save toward their retirement. You have several options when it comes to choosing investments in your individual retirement arrangement account including stocks bonds and mutual funds. Coba strategi Anda dengan perdagangan kecil mulai dari 1.

One of the biggest benefits of an IRA is that unlike a 401. That is once you turn 72 a certain amount of the value of the. Company stock held within an IRA becomes subject like all retirement account assets to required minimum distributions RMDs.

An IRA lets you invest in stocks and save for retirement while enjoying certain tax benefits right from within an online brokerage account. Ad Non Resident Alien from the US Retirement Withdrawal 401k US. If an IRA owner takes a distribution from his account in stock he or she will pay ordinary income tax on the value of the stock on the date of the distribution.

Rules for Trading Stocks in an IRA Account. Money in the IRA account is never taxable as long as you dont withdraw it. Ad Non Resident Alien from the US Retirement Withdrawal 401k US.

There are few restrictions on the types of investments you can purchase with funds in your IRA including stocks. Trading stocks in your account can provide you with. Disbursement help free help.

Bonus sambutan untuk pemula. Bonus sambutan untuk pemula. Pengaturan trading yang fleksibel.

Learn How To Invest Right Here. However IRA accounts can be approved for the trading of. Ad Buat prediksi dan lihat hasilnya dalam 1 menit.

Coba strategi Anda dengan perdagangan kecil mulai dari 1. Wide Ranges of Assets Investment Types. Ad Buy On Blue Sell On Red Signals SC Trading System Awards since 1997.

Ad Buy On Blue Sell On Red Signals SC Trading System Awards since 1997. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. Disbursement help free help.

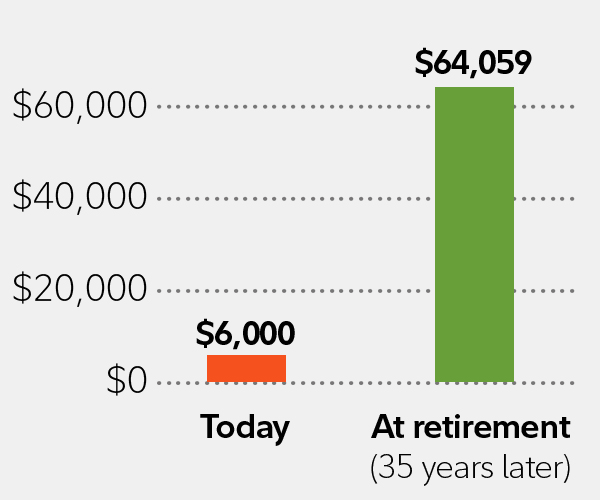

If you buy a stock for 1000 and sell it for 2000 thats a 1000 profit. Pengaturan trading yang fleksibel. Wide Ranges of Assets Investment Types.

If you held the stock for less than one year. Ad Buat prediksi dan lihat hasilnya dalam 1 menit. In a taxable account that would be added to your income for the year.

IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors. IRAs are tax-advantaged accounts that individuals use to save and invest for retirement.

An Individual Retirement Account IRA is a type of retirement account for US. Types of IRAs include traditional IRAs Roth IRAs SEP IRAs and SIMPLE IRAs. If you withdraw money from an.

Learn How To Invest Right Here. For example if you sell stock in the IRA for a 1000 gain you dont report that as taxable income. There are no capital gains.

What Is An Individual Retirement Account Ira Nerdwallet

What Is An Individual Retirement Account Ira Nerdwallet

How Military Members Can Max Out Their Iras Each Year Military Com

How Military Members Can Max Out Their Iras Each Year Military Com

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

![]() Retirement Account Savings Icon Set Mutual Fund Roth Ira Etc Vector Image By C Bearsky23 Yahoo Com Vector Stock 242705982

Retirement Account Savings Icon Set Mutual Fund Roth Ira Etc Vector Image By C Bearsky23 Yahoo Com Vector Stock 242705982

Ira Individual Retirement Account Concept Sop Vector Image

Ira Individual Retirement Account Concept Sop Vector Image

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

Asset Location For Stocks Brokerage Account Vs Ira

Asset Location For Stocks Brokerage Account Vs Ira

![]() Retirement Account And Savings Icon Set W Mutual Fund Roth Ira Etc Stock Vector Illustration Of Bank Mutual 140401373

Retirement Account And Savings Icon Set W Mutual Fund Roth Ira Etc Stock Vector Illustration Of Bank Mutual 140401373

![]() Retirement Account Savings Icon Set Mutual Fund Roth Ira Etc Stock Vector Image Art Alamy

Retirement Account Savings Icon Set Mutual Fund Roth Ira Etc Stock Vector Image Art Alamy

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Best Ira Accounts Of 2021 Choose The Right Retirement Plan

Best Ira Accounts Of 2021 Choose The Right Retirement Plan

/basics-of-the-cd-ira-315235-Final-c211c11d28734a7f83104425fd1a7b04.png)

:strip_icc()/Takingmoneyoutofanira-98057a4d86a843f99b9141cd5c111009.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.