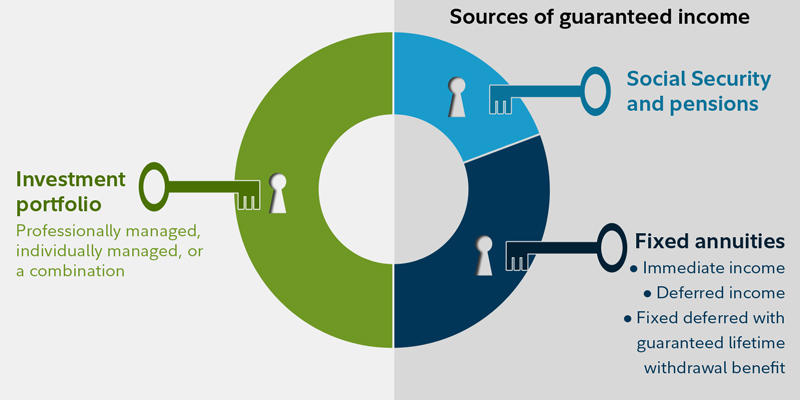

How much money do you need to retire. When considering sources of income in retirement its important to evaluate how much of that income you need to be guaranteed.

How Do You Measure The Best Retirement Income Strategy

How Do You Measure The Best Retirement Income Strategy

For 60 of pensioners this also includes income from a workplace or personal pension.

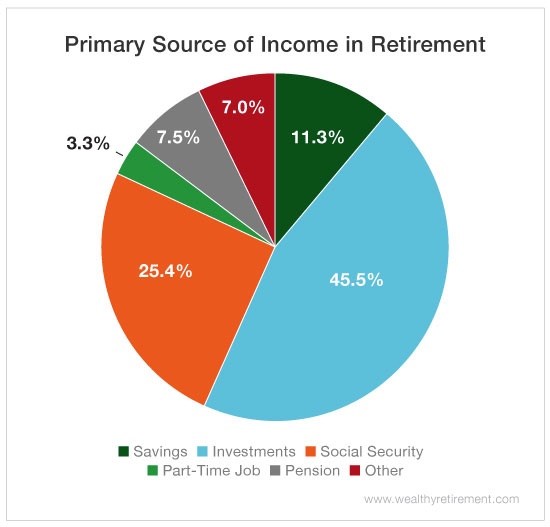

What is a good retirement income. The median annual pension benefit ranges between 9262 for private pensions to 22172 for a state or local pension and 30061 for a federal government pension and 24592 for a railroad pension. Social Security retirement accounts such as IRAs or 401ks investments pension plans annuities and even part-time employment. This estimate assumes a lifestyle that includes.

Many experts believe the median income is a more accurate representation of retirement income. Let me start by saying that simplicity is essential especially in retirement. However those median numbers still dont reflect the reality for a large swath of retired Americans.

The typical advice is that you should aim to replace 70 to 90 of your annual pre-retirement income through savings and Social Security. This can serve as a quick reference and a general rule of thumb. For 2020 the maximum monthly benefit is.

Wendy Earns 40000 pa. In June 2020 the average Social Security retirement benefit was 1514 a month. In general single people depend more heavily on Social Security checks than do married people.

Most people would agree that a good retirement income is one that offers them security that allows them to participate in the activities they want to do and provides them with a comfortable enough standard of living to be happy. How to Boost Your Pension Income. 4 The most you can receive depends on your age when you start collecting benefits.

W With current annuity rates this would buy you an income of only around 3000 extra. You cannot exactly boost your pension payments. As an example of the income multiple if you make 100000 and the recommendation you want to follow is to have 15 times your income then you would need 15 million in savings to be able to retire at age 65.

In 2020 the average monthly retirement income from Social Security was 154415. Frugality is another part as is enjoyment. In 2019 the figures were as follows.

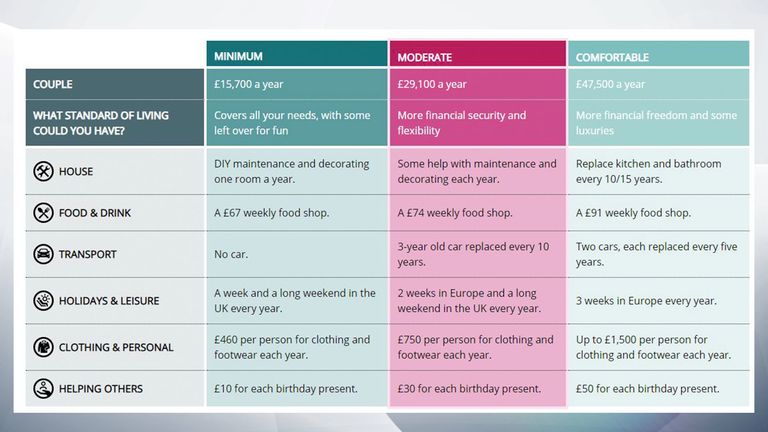

Research suggests that a couple in the UK need an annual combined income of 47500 to have a retirement with few or no money worries while a single person would need 33000. So if you spend 30000 per year youll need 600000 750000 in pensions investments and savings. Average Retirement Income In The UK According to Government research the average weekly income for a pensioner family up to two in a household in 2019 in the UK was 548 per week after taxes and housing costs.

So what makes a comfortable retirement income. Whatever your nest eggs. 3011 if you file at full retirement age currently 66 2265 if you file at age 62.

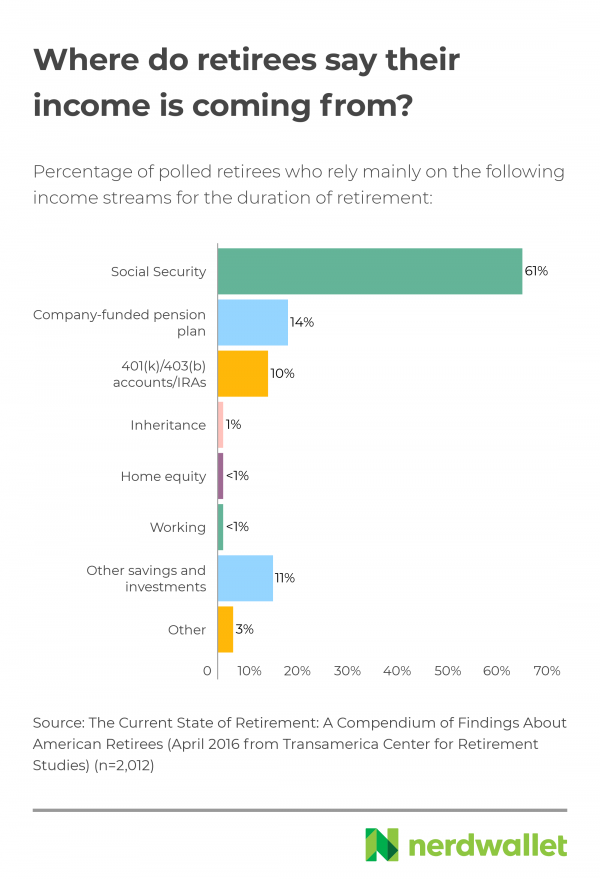

The Pension Rights Center reports that half of all Americans age 65 or older have incomes less than 24224 a year. There are some common sources of income in retirement. That said if your retirement income is close to your pre-retirement income youre doing swell.

To have the same amount of disposable income in retirement he would need a pension income of 15232 15232 minus 546 income tax leaves 14686 disposable income. As a general rule of thumb you need 20 25 times your retirement expenses. Census Bureau reports the average retirement income for Americans over 65 years of age as both a median and a mean.

Average Social Security Retirement Income. If Social Security is your only. The average UK pension pot after a lifetime of saving stands at 61897.

But 55 to 80 is a good estimate for many people. Therefore one should plan to have at least 784891 in savings. For 2021 the maximum monthly.

According to the Social Security Administration Social Security benefits make up about 38 of the income of the elderly. Ultimately it depends on how you want to spend your retirement. Youll most likely derive part of your.

But needs only 19395 income in retirement. The first retirement measurement is based on a multiple of your income. 3790 if you file at age 70.

Finally the 15 rule wont provide you with a nest egg that supplies all of your retirement income. The average length of retirement in Indiana is expected to be 14 years. For someone in Indiana to retire comfortably they will require an average annual retirement income of 56064 to cover their 46720 in yearly expenses.

Revealed How Much Cash You Need For A Comfortable Retirement Uk News Sky News

Revealed How Much Cash You Need For A Comfortable Retirement Uk News Sky News

Retirement Income Coming Up With A Plan Fidelity

Retirement Income Coming Up With A Plan Fidelity

Maximise Your Retirement Income Mlc

Maximise Your Retirement Income Mlc

Could You Get By On The Average Retirement Income Nerdwallet

Could You Get By On The Average Retirement Income Nerdwallet

How Much Do I Need To Retire At 55 2020 Financial Ltd

How Much Do I Need To Retire At 55 2020 Financial Ltd

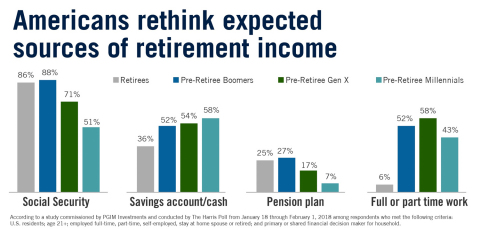

Retirement Saving Remains Elusive For Millennials Study Thinkadvisor

Retirement Saving Remains Elusive For Millennials Study Thinkadvisor

How To Ensure A Good Post Retirement Income Rupeeji

How To Ensure A Good Post Retirement Income Rupeeji

/average-retirement-savings-by-age-4155888_color2-dc8beecd73664342a6c7800d59b20c6e.gif) Average Retirement And Emergency Savings By Age

Average Retirement And Emergency Savings By Age

How Much Money Should I Save Each Year For Retirement Fidelity

How Much Money Should I Save Each Year For Retirement Fidelity

What Is A Good Retirement Income Average To Retire Comfortably

What Is A Good Retirement Income Average To Retire Comfortably

Top Primary Sources Of Retirement Income

Top Primary Sources Of Retirement Income

10 Essentials For Creating Retirement Income You Won T Outlive Good Financial Cents

10 Essentials For Creating Retirement Income You Won T Outlive Good Financial Cents

Predicting Retirement Income The Good Money Life

Predicting Retirement Income The Good Money Life

The Great Retirement Income Hunt Wsj

The Great Retirement Income Hunt Wsj

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.